Yield Curve Control, Stock Prices, and Trust

During late Summer, 1971, a repeat episode of Bonanza was pre-empted to air a special economic address from President Nixon. At the time, there was no economic emergency. The unemployment rate was 6%, which economists then considered “full employment,” and inflation was increasing but measured 4.4%. That day, Nixon discussed building what he called, “A New Prosperity.” He announced, “I am today ordering a freeze on all prices and wages throughout the United States.” As some historians tell the story, Nixon was focused on reelection in 1972 and saw the U.S. trade imbalance was increasing, this sent U.S. Dollars overseas to import goods. The imbalance left $45.7 billion of U.S. currency in the hands of foreign countries. At the time, the U.S. only held $14.5 billion in gold at $35 per ounce; this was one-third the needed reserves to cover the potential demand for international exchange of dollars to gold. Inflation was trending upward as a result of the excess unbacked dollars. The Fed acted by raising interest rates to help quell inflationary pressure and stabilize the dollar. The trend wasn’t improving.

The plan for a new prosperity immediately froze prices and wages for 90 days while creating a Pay Board and Price Commission to oversee wage and price increases as they were submitted for approval. A 10% surcharge was set on all imports to encourage purchasing U.S. made goods, and convertibility of U.S. Dollars to gold by foreign governments was suspended.

The plan was popular among voters and received favorable press. When the financial markets opened the next day, the Dow had its largest daily gain ever. Nixon was re-elected the following year. Shortly after, the country experienced a prolonged recession coupled with inflation (stagflation). The non-market price controls created significant shortages. There are examples of ranchers not shipping cattle to the market and farmers drowning chickens. The “prosperity” plan created an environment that wasn’t economically feasible for many businesses. By trying to create what many believed would be an economic ideal, the free market system had been stifled. Tinkering with the system wound up hurting the country. George Schulz, was Budget Director at the time, in 1973 he told Nixon, at least the debacle had convinced everyone, “that wage-price controls are not the answer.” Schulz was right; a decade later, Americans were still living with excessive inflation and high unemployment. Americans and investors are often in a more secure position when the playing field is left alone, when natural supply and demand mechanisms are trusted, and government tinkering in the economy and markets is kept to a minimum.

Yield Curve Control

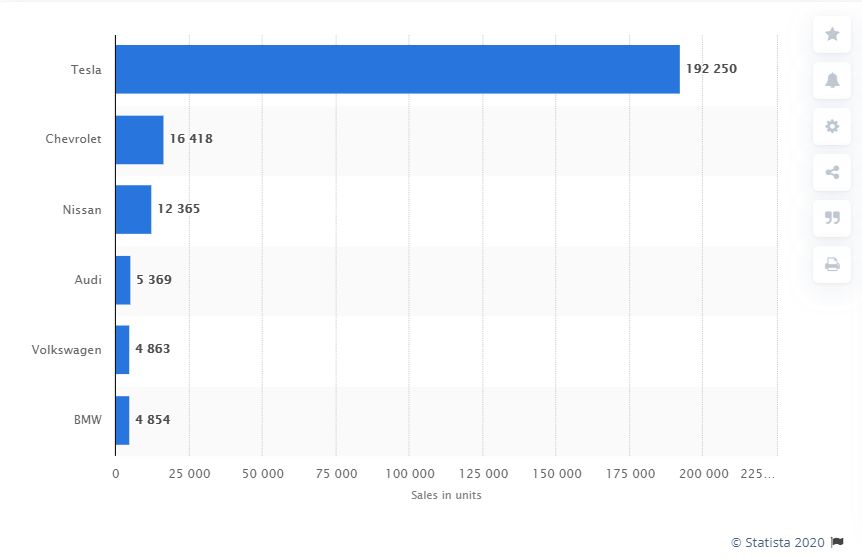

After the Federal Open Market Committee’s (FOMC) two-day meeting ended on June 11th, Chairman Powell gave an update at a press conference. It began like this: “Good afternoon, everyone, and thanks for joining us. Our country continues to face a difficult and challenging time, as the pandemic is causing tremendous hardship here in the United States and around the world. People have lost loved ones. Many millions have lost their jobs. There is great uncertainty about the future. At the Federal Reserve, we are strongly committed to using our tools to do whatever we can, and for as long as it takes, to provide some relief and stability, to ensure that the recovery will be as strong as possible, and to limit lasting damage to the economy.” He then spoke of the rise in employment, rebound in car sales and retail, low inflation, and continued weakness in sectors of the economy most impacted by the pandemic. He reminded that the Fed’s mandate is to promote maximum employment and stable prices for the American people, along with the responsibility to promote a stable financial system.

Early in his talk, Powell made sure the press and viewers understood that the Fed has lending powers, not spending powers. He reminded them that fiscal policies such as the CARES Act are enacted by legislation to place collective resources in the hands of those they deem in need. The Fed’s powers only allow lending to solvent entities. He then reminded the audience what they probably already knew — the economy is weak, and with rates at or near zero, the Fed is powerless to use its more traditional tools to implement its mandate. But, within its ability to lend to solvent entities, there are other significant methods to impact economic activity.

Powell discussed using a possible monetary approach that was brought up at the May 8th meeting. The tool the Fed hasn’t used, with the overnight rate target at zero, is bringing down the shorter end of the yield curve. The Fed believes it has the ability to lower longer-term rates using what is called yield curve control (YCC).

If YCC is implemented, it could work like this. The Fed commits to buying whatever quantity of bonds the market supplies at its target yield (presumably below market yield, above market price). Quickly, bond markets will understand the central bank’s power; the target yield then becomes the market level. YCC is effectively price control of bonds with longer maturities than fed funds. The Fed would not have a need to engage in any buying if the bonds began trading at their target levels. Transactions would be at the Fed desired level as no one is going to sell the bonds at a cheaper price unnecessarily.

There is some history to gauge success. The Australian central bank began using YCC in March, but the Bank of Japan (BOJ) has been targeting points on the yield curve since 2016. Four years ago, the BOJ committed to targeting yield on 10-year Japanese Government Bonds to around zero percent. Their goal is to ward off deflation. Their approach to maintain the yield is to have an ongoing offer out to purchase outstanding bonds of any quantity at a price equating to their target yield. During periods when investors were less willing to pay that price, the BOJ purchased more bonds to keep yields at the target.

Although the BOJ has been successful with their efforts, it’s difficult to isolate and measure their success using YCC. Yield Curve Control is just one piece of the BOJ effort. Their policy is also implementing quantitative easing, forward guidance, and negative interest rates. Their goal is also different, its primary focus has been avoiding deflation. The BOJ mix of monetary policy steps has maintained a yield of zero percent out to 10 years.

If the U.S. Federal Reserve Bank began a YCC program, it would further impede the market’s natural price discovery tools and set a course based on what they deem would have the most agreeable outcome. Also, like other unconventional policies, retaining trust and credibility is necessary for the market to work within “the plan.” If, for example, the Fed were to commit to a yield target over the next two years, and one of their mandates, such as inflation, was to begin to rise, the market would have to trust that the Fed would not abandon the policy term which was in place when market participants put on their position. If the Fed altered course, trust would fall apart. Distrust of the Fed would cause market mayhem. Powell’s term is up in 2022; the market would have to trust that his successor would also abide by any long-term commitments.

Stock Prices

Whether the government’s activities in the bond market, through the Fed, are directed to the stock market or not, they have a collateral impact on investor behavior. This impact is a problem and a benefit to savers and investors.

The reaction to the pandemic, designed to minimize stress on the medical system by containing large scale spreading, threw the economy into reverse. Although much was not understood, what we did know is that those who were older or with medical conditions were at most risk of being hurt or dying from the disease. To protect citizens, the Federal government set guidelines which were largely adopted by the states, this stalled the robust economic activity we had been experiencing. Many of the people we were most concerned with spreading the virus are retirees that live on a fixed income. Their income may come from interest payments on certificates of deposit, bonds, and even annuities. With zero or close to zero return now, this same demographic has the choice of either living off the invested principal or taking a chance in riskier alternatives such as the stock market. One large fund family sent an email out to all of its participants. The warning in the email let them know that keeping money in their money market fund could net negative returns. This encourages riskier alternatives and creates additional stock market investors that would not have been in the market otherwise, thus incrementally increasing demand.

Even before the June FOMC meeting, stocks that pay steady dividends were strong. These investments typically get a boost from the Fed lowering rates as investors such as those mentioned above look for yield and a regular income stream. Another category that can do well with specific low rate conditions is banks. They borrow short term and lend longer term. A steeper yield curve benefits earnings, while a flat curve will tend to reduce earnings. The initial impact on finance companies is usually positive as they find themselves financing loans on the books at lower short rates.

Take-Away

There’s NO Such Thing as A Free Lunch is the title of a book by economist Milton Friedman and a popular market axiom. Our economic system makes it improbable that the government can push on one lever expecting a positive result without introducing an unnatural factor to the markets that have a consequence in another area. In the case of wage and price controls in the 1970s, the impact was severe. What will happen next with current non-market adjustments remains to be felt. Market participants will collectively move to anticipate the impact of the government and the Fed interactions by adjusting their positions. This alters sector earnings, investors will then lean toward or away from different investments. An example of this that we’ve recently experienced is that a mere utterance from Washington of them implementing tariffs brings down stock prices in related sectors.

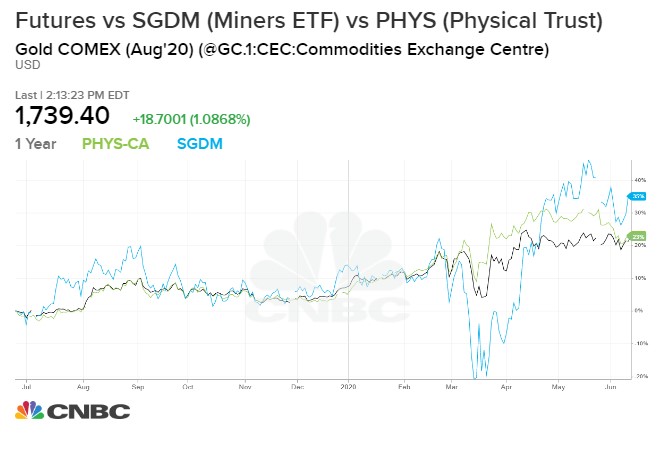

It’s essential as an investor or as someone entrusted with the investments of others to have a plan for different scenarios before they occur. Nimbleness along with foresight of possible scenarios, and preplanned actions to adjust positions when a scenario unfolds, are key to performance. Using tariffs again as an example, the stock of primarily domestic companies not doing business abroad outperformed (semiconductors, chemicals, plastics, motorcycles, furniture, appliances, and the U.S. produced solar panels). The promise by the Fed of zero overnight rates and perhaps a flatter yield curve could make winners of investors in real estate, growth companies, banks, and others.

When you’re in the middle of a game and the rules change, some will benefit, and some will fall short. Constantly changing rules is where we find ourselves as market players. Whether we approve of the new rules or not, it’s best to master them as quickly as possible.

The new and proposed rules have been announced. Don’t fight the Fed.

Paul Hoffman

Managing Editor

Suggested Reading:

The Fed’s Power and Impact are Again

Tested

Fed’s Bond Purchases Will Impact

Equity Investors

Small-cap vs Large-cap Investing

Enjoy Premium Channelchek Content at No Cost

Sources:

Federal Reserve FOMC Statement June 2020

“Fed Listens” in Richmond: How Does Monetary Policy Affect Your Community?

The Fed Just Issued a Dire Warning for the Stock Market

The Federal Reserve Tries to Tame the Yield Curve

What is Yield Curve Control?

TIAA Says Negative Yields Could Soon be a Possibility in Money-Market Products

A New Investigation of the Impact of Wage and Price Controls

Transcript of Chair Powell Press Conference