|

|

|

|

Friday, May 8, 2020

Kratos Defense & Security (KTOS)

A First Quarter Beat, But Lower Expectations for the Second Quarter

Kratos Defense & Security Solutions is a National Security technology provider with proprietary expertise in the area of unmanned aerial vehicles, electronics for missile defense systems, electronic warfare systems, satellite control and management systems and support services for emerging naval weapon systems. Commercial and state and local government revenues are about 25% of the total and comprise primarily of critical infrastructure monitoring and protection systems.

Joe Gomes, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

1Q20 Results. Kratos reported revenue of $168.9 million, above the $164.0 million consensus estimate and our $165.0 million projection. Adjusted EPS totaled $0.09, compared to a consensus and our $0.07 estimate. Adjusted EBITDA for the quarter was $16.3 million. Revenue came in at the high end of guidance, while adjusted EBITDA exceeded the $12-$15 million guidance. range.

Unmanned Continues to Lead the Way. US revenues of $42.0 million rose $7.1 million, or 20.3%, over the first quarter of 2019, driven by new target awards and additional tactical development contracts. Government Systems segment revenue increased $1.4 million to $126.9 million as organic growth in turbines, microwave, rocket systems, and cyber were offset by reductions in training solutions. satellite communications, and…

Click to get the full report.

This research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

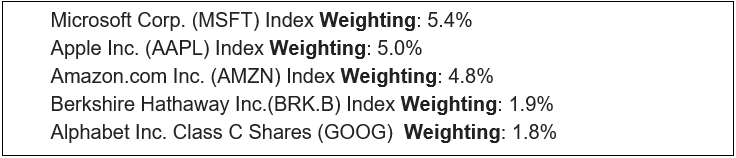

performance in a way that overstates overall market movement.

performance in a way that overstates overall market movement.