Wednesday, April 8, 2020

Media Industry Report

Quarterly Review: The Dust Has Yet To Settle

Michael Kupinski, DOR, Senior Research Analyst, Noble Capital Markets, Inc.

Listen To The Analyst

Refer to end of report for Analyst Certification & Disclosures

- Media overview. Investors likely will cheer that the first quarter results were not as bad as feared, but that will be little solace. The Q2 guidance is expected to be ugly, with television core advertising revenues expected to be down as much as 36%. But, television is expected to fair better than other mediums. Radio and Newspaper advertising could be down as much as 65%. In this report, we provide our view of the upcoming quarterly revenue outlook and the likelihood that some companies may not survive.

- What does increased TV viewership mean? TV viewership for certain dayparts are up 35% to 80%, in some cases. For this reason, television advertising is expected to be down 35%, not as bad as other mediums.

- Radio takes a big hit. Not surprising, radio managements have furloughed, reduced staff, and reduced salaries in an effort to curb the impact of the fall-off in advertising. We estimate that radio advertising could be down 65% in the second quarter. Radio always was considered to have relatively lean staff. As such, this move indicates the significant challenges that this industry faces in light of relatively heavy debt loads.

- Publishers brace for further cuts. For many publishers, the digital businesses are gaining traffic, up 50% to 250% from normal levels, which indicates the significance of their “voice” in times of heightened news flow. We believe that Publishers are likely to be seriously impacted by the weak advertising environment.

- Digital not to be spared. While web traffic increases 1.5 to 2.5 times normal levels, we believe that digital advertising will be down in the range of 25% to 35% in Q2. As such, Digital Media and Technology stocks were not spared from the malaise in the market; stock valuations declined 23% in the latest quarter.

Click ‘view previous report’ for company specific disclosures on Noble covered companies.

Overview

Bracing For The Worse

Favorable fourth quarter results, better than expected Political advertising and a great start in the New Year provided a backdrop of strong advertising momentum and a very promising 2020. By the second week of March, that optimism turned to gloom as the Coronavirus disrupted local and national advertising. What began as a trickle of cancellations and advertising campaign postponements, became a wave. Not all advertising categories were affected, but some large ones were including Travel, Restaurants, Legal Services, Local Auto Dealerships, to name a few. March is the most important month of the quarter for media companies. With the quarter off to a strong start and the impact of the fall off in advertising late in March, the “miss” in quarterly expectations likely will not be as bad as most investors fear. It is the second quarter guidance that likely will give investor pause.

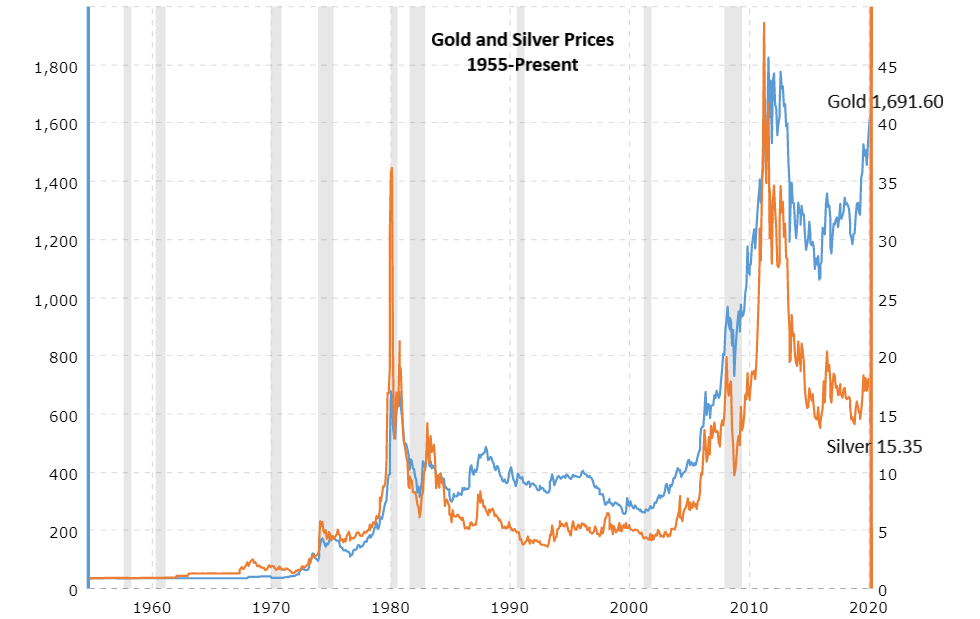

Based on our estimates, it is likely that the advertising decline will be greater than that of previous recessions, including the 2008 financial crisis and the fall-out from 9/11. In those periods, advertising declined in the range of 15% to 20%, with a varying duration of the advertising meltdown. In 2008, there was a protracted decline of several years of lackluster advertising. We expect that second quarter core television advertising could be down in the range of 32% to 36%, reflecting the disruption in the local economies as a result of “stay at home” State and Federal mandates/guidelines to combat the Coronavirus, or CoVid-19. Radio, which skews heavily toward local advertising (80% plus), could be down as much as 65%. Newspapers are expected to be down roughly 35% to 40%. The question is: How long will it take for advertising to recover? How quickly will the unprecedented unemployed get back to work? Given models for CoVid-19 that stretch well into the fall 2020 and beyond, we believe that there will be a lingering economic fallout.

In the worse case scenario of a protracted weak economy, we believe advertising will not rebound until the first quarter of 2022. In our best case scenario, advertising would grow in the second quarter of 2021. Nonetheless, we believe that media investors should be prepared for a weak advertising picture for a protracted period of time. In addition, investors should be prepared that the large influx of Political advertising, which will fall mostly in the fourth quarter 2020, may be disappointing as well. In our view, Political advertising may be adversely affected as large donors rein in spending and/or races become less competitive.

Our best estimates anticipate core television advertising to decline in the range of 32% to 36% in the second quarter, down 25% to 30% in the third quarter, down 13% to 18% in the fourth quarter, and, finally, down 12% to 17% in the first quarter 2021. We believe that Radio and Newspaper advertising will decline more than television. This weak advertising outlook may be devastating to highly levered companies and it is certain that some will need to financially restructure and/or seek waivers from creditors.

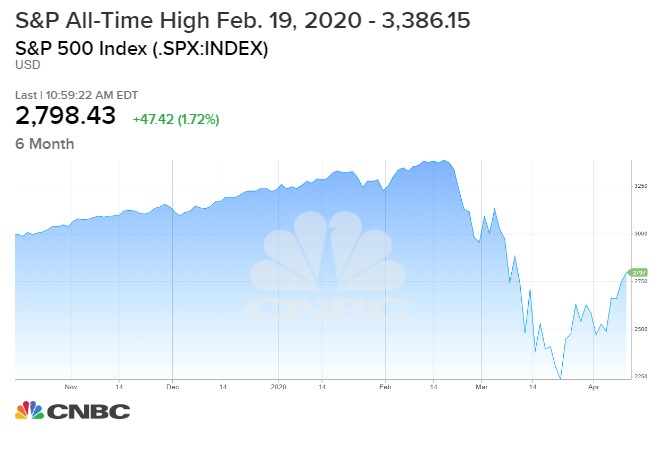

As Figure #1 illustrates, the fallout from CoVid-19 on the media stocks has been swift. Media stocks declined between 40% to 50% on average in the first quarter 2020. This, after a year of nice stock performance in 2019, with the average media stocks up in the range of 10% to 17%. The more debt levered companies performed more poorly in the first quarter, with some stocks down 50% to 70%. In our view, the weakness in this group reflects the prospect that some will not be able to service their debt given the profound advertising weakness. For some of those, there is further downside risk. As such, we urge caution to investors looking to bottom fish on the recent weakness, be opportunistic, and seek companies with significant financial flexibility to withstand the unprecedented deterioration in fundamentals.

Figure #1

Television

What does increased viewership mean?

Under normal circumstances, the TV industry would be able to capitalize on an unprecedented spike in viewership. Television viewership is up 33% and even as high as 80%, in certain day parts for some television stations. The increase viewership is due to government guidelines/mandates for people to stay at home and their watching TV. Notably, the viewing is not just news, but across all programming. Typically, higher viewership would give broadcasters the leverage to seek increased advertising rates. But, not when there is low advertising demand.

As a result, advertising is significantly down in spite of increased viewership. Notably, core television advertising revenues are not expected to be down as much as other mediums. That is not saying much given the we expect television core advertising to be down as much as 32% to 36% in the second quarter, far greater than previous recessionary cycles when advertising was down 17% to 20%. At this point, we do not anticipate that there will be a quick recovery, as we expect that economic activity will not likely rebound for a few quarters at best. In our view, there will be societal behavior changes that may adversely effect parts of the economy, including travel, sporting, concert and other entertainment venues that host large gatherings. As mentioned earlier, we expect core television advertising to decline in the range of 32% to 36% in the second quarter, down 25% to 30% in the third quarter, down 13% to 18% in the fourth quarter, and, finally, down 12% to 17% in the first quarter 2021.

While core advertising is expected to be better than most mediums, television will benefit from the influx of Political advertising, particularly in the fourth quarter, and from Retransmission revenue. While many analysts, including myself, have raised Political advertising expectations following the strong fourth quarter 2019 results, we believe that the recent events may cast some doubt on that prospect. Importantly for the industry, Retransmission revenue has become a significant portion of total Television revenue. In 2008, Retransmission revenue was a mere 15% of total TV revenue. Now, Retransmission revenue is over 50%. This growing revenue stream should provide a ballast to TV broadcast company’s revenue and cash flow.

Television cash flow is expected to be significantly impacted by the dramatic falloff in revenues. We estimate that second quarter cash flow for the industry will be down roughly 45% to 50% in the second quarter, down 30% in the third quarter, and down 15% in the fourth quarter.

Television stocks declined 47% in the latest quarter, following a strong performance in 2019, up a solid 17%. The TV stocks were nearly uniformly down, which suggests that investors have not differentiated between the winners and the losers. We continue to like Gray Television (view most recent report) and E.W. Scripps (view most recent report) as among our favorite plays in the industry. Most recently, Gray cancelled its interest in acquiring TEGNA (view most recent report). Given the current environment, this appears to be a good move. While E.W. Scripps has a significant amount of debt following recent acquisitions, we believe that the company has financial flexibility to manage through the crisis and has attractive assets it could sell to more aggressively pare down debt. Furthermore, the company is expected to benefit from a step up in Retransmission revenue from Comcast subs and the recent negotiation of Retrans for roughly 42% of its subscriber base.

Radio

A serious issue

Like most advertising mediums, the first quarter Radio advertising started out strong and faded quickly in March. The stay-at-home guidelines and mandates as a result of the strategy to combat the Coronavirus pandemic significantly affected the Radio industry. It is estimated that over half of Radio listenership is in the car. Not surprisingly, advertisers postponed or cancelled advertising as stay-at-home policies were implemented. Furthermore, Radio is a very transactional business and was deeply affected by the closing of businesses.

Based on our estimates, we believe that second quarter Radio advertising revenues are likely to be down a stunning 65%. We believe that some diversified companies with meaningful digital businesses or companies in smaller communities likely will perform better than that. The larger markets are where most of the economy is felt. Coincidently, the larger markets were the most affected by the Coronavirus.

The recovery in Radio depends upon how quickly people get back to work in offices and the economic stimulus policies take hold. We estimate that it will be a slow climb back. As such, we estimate that third quarter revenues will be down 35% and fourth quarter revenues down 25%.

Radio companies operate fairly lean. As such, the steep revenue decline will be significant to cash flow. As a result, there have been drastic measures to preserve cash flow by streamlining staff, corporate management wage reductions, postponement of dividends, cut back in planned capital expenditures, to name a few. These measures are necessary given that most in the industry have levered balance sheets, in the range of 4 to 6 times cash flow. We would expect that companies will draw upon their revolvers to have cash to fund its business as it navigates through the crisis. But, it is likely, given our revenue forecast, that debt covenants for some will be tripped. In our view, some of the radio companies will not survive without a financial restructuring. At this point, the industry is looking at ways that it may receive support from the US Government and Small Business Administration to ride through the crisis.

Not surprising, the Radio stocks have been some of the hardest hit, down a roughly 50% within the past quarter. Some stocks, like highly leveraged Cumulus Media (view most recent report) and Entercom are down near 70%. Given the uncertainty over the duration of the stay at home orders and the timing of a reboot to the economy, we encourage investors to seek Radio companies that are diversified into areas not as adversely affected by the weakness, such as Digital businesses. In addition, we prefer companies that are in smaller markets, which do not appear to be as affected by the economic downturn. Our current favorite play in the industry is Townsquare Media (TSQ) (view most recent report).

Publishing

Cost cutting is second nature

The newspaper industry already faced secular challenges to its business. As such, managements have been accustomed to cutting costs and managing cash flow. But, that action was staying ahead of the curve. In this case, it would be hard for management to react that quickly to the complete advertising meltdown that happened the last weeks in March. We believe that newspapers will fare better than Radio, however, given that audiences have gravitated to news sources following the latest measures to combat the Coronavirus. In fact, management’s have indicated that traffic to its websites have increased 1 1/2 to 2 1/2 times the normal levels.

We estimate that publishing advertising will be down roughly 35% to 40%, but Digital publishing advertising will decline a more modest 15% to 20%. We estimate that publishing advertising will be down 30% to 40% in the third quarter and Digital advertising to be down a more modest 10% to 12%. In the fourth quarter, we anticipate advertising to be down 25% to 30% with Digital advertising to be down 5% to 10%.

The industry has taken a significant amount of fixed costs out of the business. But, this level of advertising decrease will make it hard to preserve cash flow. It is not surprising that there has been internal communications at Publishing companies of significant cost reductions, including management salary reductions, staff reductions, capital spending postponement and the like. We believe that debt heavy companies, like Gannett, may need to financially restructure. Notably, McClatchy (view most recent report) filed for voluntary Chapter 11 in the last quarter, before the devastating impact of the Coronavirus was realized.

The Publishing stocks actually performed better than most media companies, down 37% in the quarter. The shares of Gannett, GCI, declined 77% in the quarter, as investors raised concern over the company’s debt leverage following the merger with New Media. In looking at this sector, we favor Tribune Publishing (view most recent report). In our view, the company has the balance sheet to ride through the storm, with a large cash position and virtually no debt.

Digital Media & Technology

Holding up

The various Digital indices have held up significantly better than its traditional advertising peers, but were largely down. As a group, Social Media stocks performed fairly well, down a moderate 19%. We believe that this segment is benefiting as people connect with family and friends through social media rather than in person visits. Consequently, Facebook, a leading social media company was down roughly in line with the index. Digital Media stocks fell a moderate 23% in the latest quarter, with the standout being Netflix, up roughly 16%. The company has been a beneficiary of the stay-at-home mandates. Marketing Technology companies were down 21.9% in the quarter, holding up pretty well. Ad Tech companies performed more in line with the traditional media companies, down 33.6%, with the shares of SRAX performing better than its peers, down 19.3%.

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Director of Research. Senior Equity Analyst specializing in Media & Entertainment. 34 years of experience as an analyst. Member of the National Cable Television Society Foundation and the National Association of Broadcasters. BS in Management Science, Computer Science Certificate and MBA specializing in Finance from St. Louis University. Named WSJ ‘Best on the Street’ Analyst six times.

FINRA licenses 7, 24, 66, 86, 87.

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of

transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc..

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS |

% OF SECURITIES COVERED |

% IB CLIENTS |

| Outperform: potential return is >15% above the current price |

93% |

46% |

| Market Perform: potential return is -15% to 15% of the current price |

7% |

6% |

| Underperform: potential return is >15% below the current price |

0% |

0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same. Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 11366