|

|

|

|

What are Negative Oil Prices Telling us about the Future for Energy Companies?

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

On Monday, the May oil contract for West Texas Intermediate (WTI) oil turned negative for the first time ever. WTI futures, which expire on Tuesday, settled at $(37.63) on Monday before climbing back to positive on Tuesday. Negative prices reflect the fact that producers are willing to pay consumers for May delivery under fear that storage will run out by the end of May. WTI pricing is for delivery at Cushing, Oklahoma. Last week, the Energy Information Administration (EIA) reported that storage facilities at Cushing, Oklahoma were 72% full as of April 10. So, are negative oil prices a temporary fluke caused by unusual circumstances, or is it a harbinger of bigger problems to come?

Reasons to Not Be Concerned

WTI is not a good measure of the value of oil. WTI pricing is the most common reference for North American producers. It is, however, not the only reflection of the value of oil. International producers often refer to Brent oil prices, which measures oil prices in the North Sea, as a more relevant price. Brent oil prices closed Monday above $20 per barrel before dipping into the high teens on Tuesday. WTI pricing is complicated by the fact that the pricing point is land locked. Oil has nowhere to go if storage is full given pipeline constraints between Cushing and Henry Hub that have developed due to increased Permian oil production. North Sea oil, on the other hand, can head to many different ports or even stay on tankers if needed.

It’s the May contract only. It is worth noting that while the May futures contact turned negative, the June contract remained near $20 per barrel on Monday before settling at $11.57 on Tuesday. This is not necessarily a reflection that traders believe the supply demand situation will improve in 30 days but more a representation that the issues facing the May contract are storage related. May contract issues are worsened by the fact that May is a shoulder month for oil demand -after the winter heating season but before the summer driving season. The EIA typically reports a peak oil storage date in the middle of May.

A demand response is coming. President Trump announced plans to buy 75 million barrels of oil to place into the nation’s strategic reserve. The purchase would move the strategic reserve from 80% full to 89% full (total reserve capacity is 797 million barrels). The purchase represents approximately 1 day of world oil demand. As such, the move, while positive, is unlikely to sop up much of the excess supply, and it will be unable to be repeated. Of bigger importance is when the economy will start to rebound as virus preventions are eased.

The supply response is coming. Opec Plus agreed to cut 9.7 million barrels of daily oil production beginning in May. Further cuts are possible should oil prices remain at depressed levels. Of course, this will not help domestic oil production facing limited storage options but should help the overall equation. We suspect that domestic oil producers have all but cancelled plans for future drilling. This will lower supply but may take a year or so to have an impact. A more immediate drop in supply would come if producers began shutting in production from existing wells. Texland Petroeum LP announced the shut in of its 1,211 oil wells on April 13. ConocoPhillips announced the shut in of 125,000 barrels of oil per day in Canada on April 20th. Other smaller producers have followed suit. Jeffrey Currie, head of commodities at Goldman Sachs, estimates that one million barrels of oil per day has been shut down.

Concern for Oil & Oil Service

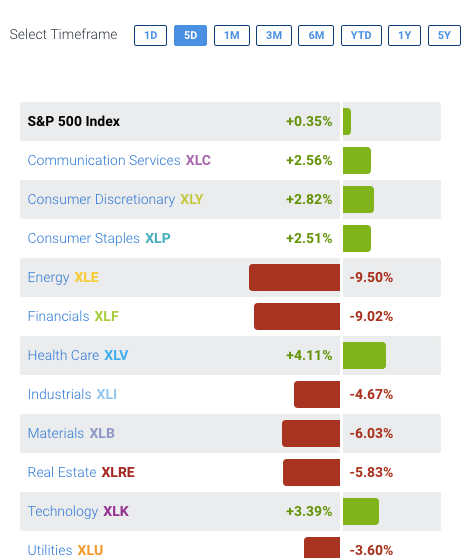

Negative prices reflect a drop in demand. A study by HIS Markit estimates that world oil consumption has declined 25 million barrels per day, or approximately 25%. The 9.7 million BBL/day production cut by OPEC Plus was impressive but offsets less than 40% of the drop in demand.

OPEC Plus still has incentives to cheat. OPEC has a history of agreeing to production decreases and then not living up to agreed levels. Countries facing economic hardships will certainly have an incentive to produce above their set level.

Production costs continue to decline. Rig rates and other costs are falling as oil service companies compete to create revenues. Energy companies that are still drilling are focused on their top drilling prospects, which have the lowest costs. The results could mean oil prices remain low until there are signs that demand has returned.

Summary

Negative oil prices make good headline news. Investors should keep in mind that a negative oil price for the May WTI contract is not indicative of the value of oil. Other contacts for different delivery dates or locations have not suffered the same effect as the May WTI contract. Instead, negative prices reflect short-term issues associated with storage at a difficult time of the year for oil prices. That said, the glut of oil clearly reflects a sharp drop in demand due to attempts to control the spread of the coronavirus. A supply response; whether it be from OPEC Plus, decreased domestic drilling or the shut in of existing production, is coming but will take months if not years to offset the drop in demand.

Suggested Content:

Energy

Sector Review – April 2020

inPlay

Oil – Models Updated for Lower Oil Prices April 2020

Sources:

https://www.barrons.com/articles/oil-stocks-producers-negatve-futures-prices-contract-barrels-51587414871?siteid=yhoof2&yptr=yahoo, Avi Salzman, Barrons, April 20, 2020

https://www.theweek.in/news/world/2020/04/21/explainer-oil-prices-negative-us-wti-what-does-it-mean-consumers-pump-gas-prices.html, The Week, April 21, 2020

https://www.texastribune.org/2020/04/06/texas-oil-producers-shutting-wells-coronavirus-dispute-plummet-prices/, Mitchell Ferman, The Texas Tribune, April 6, 2020

https://www.axios.com/coronavirus-oil-oversupply-ad858690-cce4-4768-8d28-4165349c2624.html, AXIOS, April 13, 2020