Contango, ETFs, and Alligators

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

There is a lake two miles from my house in Florida, where I often waterskied before the county-wide lockdown of public parks. Years back, as a transplanted New Yorker, the idea of jumping into a dark freshwater lake wasn’t comfortable. After-all, Lake Ida is connected to a chain of alligator-infested waterways. But I set out to educate myself, then decide on my own if the other people in the lake were taking more risk than I cared to. My research included boating with a number of experienced friends whom I believed to be both sane and knowledgeable. I also read about the fears of the primitive reptiles; I Googled information on their food preferences and even their mating habits. My would-be skiing partners thought I was ridiculously cautious. I didn’t care. If I can’t see below the surface of something, I need to gauge the risk in another way. Or just stay out.

Eventually, I learned what I needed to and became a regular slalom skier on Lake Ida. I would only go midday when I was surrounded mostly by wakeboarders and tubers. Although the activity from all the other boats doesn’t make the best conditions for running a slalom course, it does, to the best of my understanding, keep alligators away. So, as long as there is a activity going on up top, I feel confident that the sharp-toothed creatures below will leave for quieter waters.

On Thursday, I took a bike ride over to the lake to get out of the house and see what it looks like after six weeks of close to zero boat traffic.

It was exceedingly quiet. The weeks of a prolonged lack of activity concerned me. Although I can’t be sure, I’d suspect that close to zero boat traffic from the coronavirus lockdown may have changed the risk level of now entering the water. There has been nothing for weeks to spook the gators. The thought ran through my head that I will not rush back onto Lake Ida with my ski too soon after the county allows.

The lockdown has unexpectedly changed the risk profile of many seemingly unconnected activities. Our health and what is now necessary to stay healthy tops this list. Investments, and finding returns while staying out of trouble probably fall into many people’s top three on their own list. Investing, in particular, should now be done with even more research. The environment has changed, and clarity is harder to come by.

Below the

Surface of an ETF

Last week, retail investors, many trading off free apps such as Robinhood and SoFi

Invest, learned an expensive lesson about clarity. They continued to pile into a popular ETF with enthusiasm, as it continued to trade lower. The fund seemed to offer greater and greater value while it became cheaper and cheaper versus crude oil, which investors expected it to track. However, the ETF had become a different “animal.” The realignment with crude did not pan out. On the other side of this trade, selling into the frenzy, were more aware professionals who were shorting the ETF. This worked well for the more experienced traders who pulled in as much as $286 million and may have earned as much as 110% (Feb. 27 to April 21).

The underlying positions in ETF ticker symbol USO (United States Oil Fund, LP) had for years been the front-month oil futures contract. Last week, USO redefined and “loosened” their underlying mix, twice. The new “allowable” universe veered dramatically from what many USO ETF investors expected from their investment. As they announced the funds underlying changes, investors paying attention discovered it would also include an 8 for 1 reverse stock split and a temporary structure as a closed-end fund

It still pulled in even more seemingly unaware investors. A large number of the buy transactions were conducted on apps, so the demographic was young investors. It’s presumed that most didn’t know what the underlying investments were in the ETF. That is because the investments now making up the fund are so varied that it is hardly possible for any investor to know what category of oil exposure they own.

“Given the way disclosures are currently being given by the

fund, it’s almost unanalyzable, because you don’t have a sense of what the

weighting along the futures curve is…” – Peter Cecchini, Chief Market Strategist, Cantor Fitzgerald

Staying On

Top of your Investment

On Wednesday (4/22/20), virtually every oil contract traded higher. USO, which investors had thought of as a proxy for the price of oil fell 10.6% that day. This decline contributed to the 40% spiral over three consecutive trading days, and to the 80% pounding USO owners have endured on the year.

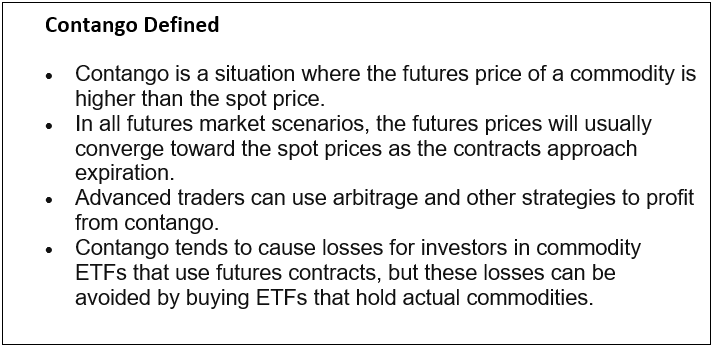

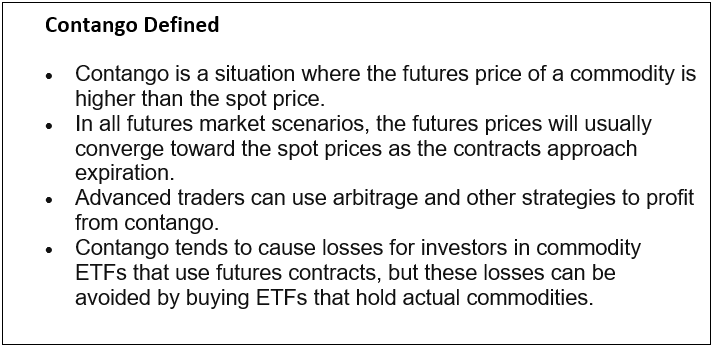

Broadening the variety and expiration date of futures contracts USO now holds was likely adopted by the fund managers as a self-preservation measure after the May Oil Futures Contracts had experienced its own selling frenzy. In a historical move, the selling brought the price of the contract negative. The reason for the negative price is that the holders of the contract are contractually obligated to take delivery. Worldwide storage for crude oil is at capacity. Taking delivery could actually mean filling a ship and letting it sit idle until the glut burns off. That’s expensive, so the normal convergence with spot prices didn’t unfold as normal when a contract nears expiration. If the futures price and spot price of a commodity don’t converge as expiration nears, a situation that market participants call “contango” occurs. Contango can wreak havoc in ETFs that invest in futures contracts rather than actual stocks or commodities.

USCF is the manager of the ETF USO. The company has as its tagline, “INVEST IN WHAT’S REAL.” At the moment, it is difficult or impossible to know what is real with their fund. On April 28, the reverse 8 for 1 stock split will take place. This resulting higher cost of share price may dissuade some of the smaller investors that prefer more shares and lower dollar prices at entry. USO’s lower cost per share has attracted inflows every day since April 8, for a total of about $3.3 billion. Demand for the ETF was so high that the fund exhausted the number of shares it was allowed to issue under past filings. USO has asked the U.S. Securities and Exchange Commission for permission to register an additional 4 billion shares, according to USCF.

Take-Away

Determining what an investment will do next is never certain. But putting yourself into an ETF with uncertain investment parameters or exposure may be riskier than it needs to be. Investors need to know as much as they can about what is going on below the surface. USO is the biggest exchange-traded fund representing oil prices. Yet, Wall Street veterans want no part of it., except perhaps as a short.

Investors with a low-risk tolerance need to understand any animal they may encounter before they enter its territory. If there isn’t a solid understanding with trusted analysis and research, it’s a roll of the dice. The markets have all changed with the economic shutdown and eventual reopening. This change has surely brought great opportunity. First, be sure to understand what is likely happening below the surface of any investment. Or just stay out.

Paul Hoffman

Managing Editor

Suggested

Reading:

What are

Negative Oil Prices telling us?

Why Index

funds Could be a Mistake in 2020

How

Investment Professionals are Preparing for the New Decade

Sources:

USO – Invest in What’s Real

Biggest Oil

ETF Almost Unanalyzable

Oil ETF

Chaos

What is

Contango and Backwardation

What is Spot

price

Brokerages

Restrict Clients On Positions They Can Take In Oil

USO Overview

USCF Announces One-for-Eight Reverse

Share Split FOR USO

Short

sellers make nearly $300 million betting against retail investors’ favorite oil

fund