|

|

|

|

|

|

Looking for the next apple? This is the orchard.

|

|

|

|

Market participants, of all levels, have been wondering aloud about Warren Buffett’s low profile. Shortly after other wealth destroying market events, the “Oracle of Omaha” tended to step-up and calm fears early in the financial turmoil. The orchestrated economic stoppage of today’s lockdown has left investors wondering. They’re wondering if and when they’ll get a glimpse into the thinking of the highly respected Chairman of Berkshire Hathaway. Well, they don’t have to wonder much longer. His “silence” will end Saturday (May 2) at the Berkshire Hathaway shareholder meeting (held virtually). The discussions from that meeting have the potential to set the market tone in a number of industries and even the overall mood.

Has He

Already Shown His Hand?

Reviewing his actions and experience after the financial bubble burst late Summer 2008 may lend clues into his current focus. There was an excellent op-ed article written by Buffett for The New York Times just one month after the recognized start of the 2008 financial crisis. The piece was titled “Buy American – I Am” and contains one of his most famous quotes; “A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful.” The article uses market history to make compelling arguments for ignoring fear and to confidently move cash from the sidelines and into the market. The only problem with the article, at least according to the author himself; is, he was wrong.

The Oracle of Omaha used the op-ed to “cheerlead” for the country and the markets. He wrote about taking his personal account from 100% U.S. Treasuries to making significant investments in U.S. Companies. The piece helped calm fears and served to inspire others to be comfortable investing while the extent of trouble was not fully clear.

Berkshire Hathaway, in 2008/2009, for its part, took large positions in beaten-up companies with excellent brands and excellent histories. The investments back then included Harley Davidson, General Electric, Tiffany & Co, and construction materials giant USG, among others. When discussing the crisis many months later, Buffett had lamented his timing and said he wished he had written his op-ed later than he did. He had spoken too soon.

This (jumping in early) by itself could easily explain his now shying away from making any bold statements. He is famous for confidently investing when others are fearful, but it is difficult to know when fear is near its peak. In 2008 he expressed extreme optimism only one month after the start of the market crisis. He was reminded that one month is too short to assess a new and highly unusual situation.

Charlie Munger, Warren Buffett’s business partner and Vice-Chairman of Berkshire Hathaway, spoke with The Wall Street Journal a week ago. He was very clear as to what was going on in the Berkshire Hathaway investment mindset and the deals coming their way. In short, he made clear, “The Phone Is Not Ringing Off the Hook.”

The Vice Chairman also said, “Warren wants to keep Berkshire safe for people who have 90% of their net worth invested here. We’re always going to be on the safe side. That doesn’t mean we couldn’t do something pretty aggressive or seize some opportunity. But basically, we will be fairly conservative. And we’ll emerge on the other side very strong.”

Munger also noted that they generally don’t go out searching for deals with companies. In the past, corporations looking to discuss their situation came to them. He said large corporations are most likely having those conversations with the U.S. government. Certainly, the U.S. has deeper pockets and greater ability to help than Berkshire Hathaway.

What Others are

Saying

The speculation and consensus among investors is that he is quietly deploying capital and selectively buying shares of companies that are the backbone of America. In a podcast for The Knowledge Project titled “Getting Back Up,” Bill Ackman, CEO of Pershing Square Capital Management, discussed what he thinks Berkshire Hathaway may be doing and should be doing. In the podcast, Ackman is heard saying: “I’m surprised they haven’t done anything yet that’s visible, but my guess is they’ve been buying stocks a lot…” The hedge fund manager added, “The big opportunity for Berkshire is Berkshire itself.” He explained it was a “cheap stock” before the market route and now is a “real bargain.” Class B shares of BRK (BRK-B) closed Wednesday at $189.61.

Rest Assured He Will Be Comforting

If history offers any indication, Warren Buffett believes markets always come back. As an “oracle” his projections usually have a soothing mood of confidence. This is not to suggest that anyone should believe the markets have seen their worst, or that everything will perform equally. Instead it would suggest there are many bargains within the equity markets, but the strength of the overall market may have gotten a bit ahead of itself.

As far as thoughts he shares on sectors and industries within the market, the investors will be listening for tips relative to performance spreads between stock classifications, which industries he sees value within, and if he is more likely to be looking offshore this time.

The normally lavish Berkshire Hathaway Annual meeting will be held virtually for the first time. It has been announced that Charlie Munger, who is 96, will not be attending. You can “attend” yourself on Saturday with this live stream this link.

Suggested Reading:

“The Big Short” Dr.

Michael Burry’s Views on the Shutdown

Why Index Funds Could be

a Mistake in 2020

What Now? Post Pandemic

Stock Market Investing

Register for Channelchek Premium Content and Tools at No Cost!

Sources:

Berkshire Hathaway 2020 Meeting Press

Release

“Buy American – I Am” NYT, 10/16/08

|

|

|

|

Thursday, April 30, 2020

Orion Group Holdings, based in Houston, Texas, is a specialty construction company within the Marine and Industrial Construction sectors, with operations focused in the continental United States and Caribbean. Revenue is split roughly 50/50 between a Marine Construction segment that provides marine facility, pipeline and structural construction services and a Commercial Concrete segment that provides turnkey concrete services in the light commercial and structural construction markets.

Poe Fratt, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Another strong quarter driven by solid execution. 1Q2020 gross profit of $19.8 million and EBITDA of $12.2 million easily beat our estimates of $12.0 million and $6.2 million, respectively. Gross margin of 11.6% and EBITDA margin of 7.3% were ~400 basis points higher than expected. Main driver was higher Marine profitability due to strong execution and higher equipment utilization. Concrete also improved modestly.

Suspending 2020 EBITDA guidance due to uncertainty caused by COVID-19. Minor disruptions seen to date and bidding activity continues in both segments, but taking the safe route, similar to many other companies. Our revised estimate is…

Click here to get the full report.

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

|

|

|

|

Thursday, April 30, 2020

Orion Group Holdings, based in Houston, Texas, is a specialty construction company within the Marine and Industrial Construction sectors, with operations focused in the continental United States and Caribbean. Revenue is split roughly 50/50 between a Marine Construction segment that provides marine facility, pipeline and structural construction services and a Commercial Concrete segment that provides turnkey concrete services in the light commercial and structural construction markets.

Poe Fratt, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Another strong quarter driven by solid execution. 1Q2020 gross profit of $19.8 million and EBITDA of $12.2 million easily beat our estimates of $12.0 million and $6.2 million, respectively. Gross margin of 11.6% and EBITDA margin of 7.3% were ~400 basis points higher than expected. Main driver was higher Marine profitability due to strong execution and higher equipment utilization. Concrete also improved modestly.

Suspending 2020 EBITDA guidance due to uncertainty caused by COVID-19. Minor disruptions seen to date and bidding activity continues in both segments, but taking the safe route, similar to many other companies. Our revised estimate is…

Click here to get the full report.

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

|

|

|

|

Wednesday, April 29, 2020

Trovagene, Inc. is a clinical stage biotechnology company focused on the development of new therapeutics for hematology and oncology. The company’s clinical programs of Onvansertib (PLK1 inhibitor) include Phase 1b/2 study in AML, Phase 1b/2 study in mCRPC and Phase 1b/2 trial in KRAS-mutant colorectal cancer.

Cosme Ordonez, MD, Ph.D., Senior Life Sciences Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Trovagene’s lead drug effective in 88% of mCRC patients. The company yesterday released interim results from a Phase Ib/II clinical trial on the use of onvansertib for the treatment of metastatic colorectal cancer (mCRC) patients carrying KRAS mutations. Onvansertib is a first-in-class, third generation highly selective inhibitor of PLK1. In the trial, 7 out of eight patients (88%) responded to a drug treatment combination.

Data was presented at AACR 2020 Annual Meeting. The results were presented by Dr. Afsaneh Barzi at the American Association for Cancer Research (AACR) conference. Dr. Barzi was the principal investigator of the study. She is an associate professor of clinical medicine at Keck School of Medicine of USC and medical oncologist at…

Click here to get the full report.

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

|

|

|

|

Introduction

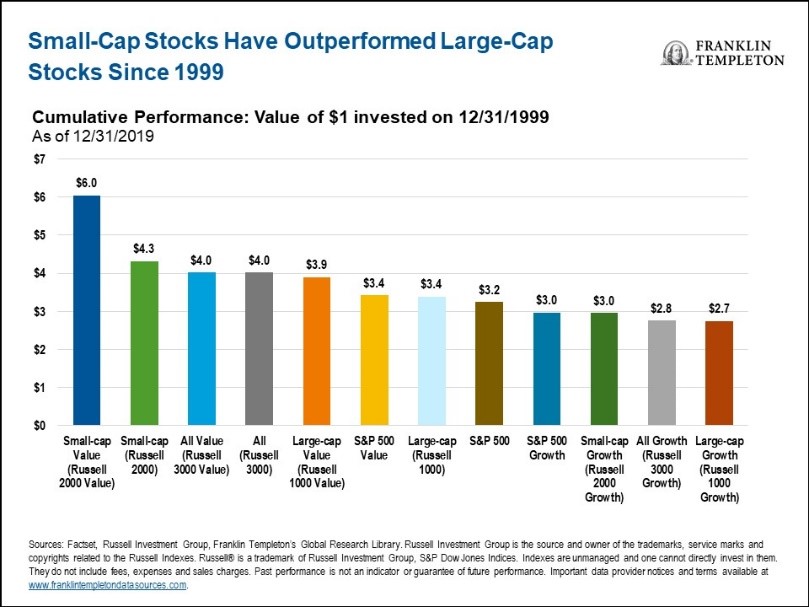

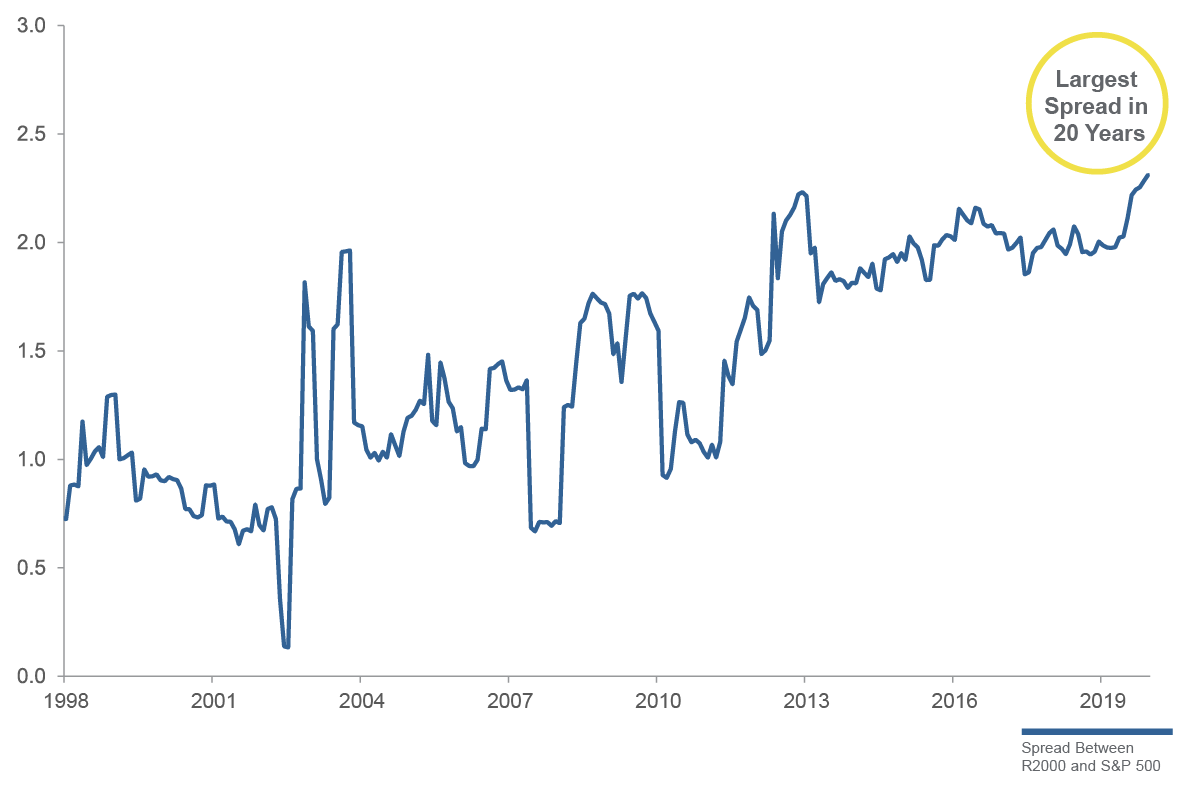

Small-cap stocks rose 20% in the month of April to date, outpacing a 14% rise in the S&P 500 Index and a 13% rise in the Dow Jones Industrial Average. The outperformance came after an underperformance by small-cap stocks in March when concerns of the economic impact of the Coronavirus weighed on investors’ minds. With a government stimulus package spurring the economy and the stock market, is now the time for investors to shift focus towards small-cap stocks? Before doing so, a review of the pros and cons of small-cap versus large-cap stocks seems in order.

The Case for Small-Cap Stocks:

The Case Against Small-Cap Stocks

Spread Between Small Caps and Large Caps (Net Debt to EBITDA)

Summary

Experts may never be able to give a definitive answer to the question about whether it is better to invest in small-cap or large-cap stocks. The correct answer lies in what the investor believes the overall economy and stock markets will do in the future. It also depends on individual investor risk tolerance and liquidity needs. Nevertheless, it is safe to say that small-cap stocks can be an important component of any investor’s equity portfolio as a means of providing diversity and growth. Historically, that has been especially true during periods after a market correction.

Suggested Reading:

Why

Index Funds Could be a Mistake in 2020

What

Now? Post Pandemic Stock Market Investing

Stock

Index Adjustments and Self-Directed Investing

Register for Channelchek Premium Content and Tools at No Cost!

Sources

https://www.thestreet.com/markets/what-the-russell-2000-can-tell-us-about-the-u-s-economy-14933740, Scott Bauer, The Street, April 23, 2019

https://money.usnews.com/investing/investing-101/articles/why-you-should-be-investing-in-the-russell-2000-index, Ellen Chang, US News, January 4, 2019

https://www.yardeni.com/pub/stockmktperatio.pdf, Dr. Edward Yardeni, Yardeni Research, April 27, 2020

https://westwoodgroup.com/insight/quality-is-the-key-to-getting-the-shift-to-small-cap-value-right/, Westwood

https://www.thebalance.com/when-is-the-best-time-to-invest-in-small-cap-stocks-2466854, Kent Thune, the balance, January 10, 2020

https://seekingalpha.com/article/4326493-5-reasons-to-consider-investing-in-small-cap-value-stocks, Franklin Templeton Investments, February 23, 2020

|

|

|

|

Wednesday, April 29, 2020

Salem Media Group is America’s leading radio broadcaster, Internet content provider, and magazine and book publisher targeting audiences interested in Christian and family-themed content and conservative values. In addition to its radio properties, Salem owns Salem Radio Network, which syndicates talk, news and music programming to approximately 2700 affiliates; Salem Radio Representatives, a national radio advertising sales force; Salem Web Network, a leading Internet provider of Christian content and online streaming; and Salem Publishing, a leading publisher of Christian themed magazines. Salem owns and operates 115 radio stations, with 73 stations in the nation’s top 25 top markets – and 25 in the top 10. Each of our radio properties has a full portfolio of broadcast and digital marketing opportunities.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Q1 likely to be disappointing. Total company revenues is estimated to be $58.29 million and adj. EBITDA from continuing operations of $4.79 million. We believe that the company did not aggressively reduce costs as the pandemic unfolded and is positioning to benefit from US government programs to support small businesses.

Challenging Q2. Quarterly revenues are expected to decline 22.5% to $50.1 million with cash flow (adj. EBITDA) expected to turn negative to $3.8 million. The company is expected to perform better than many of its media peers due to its relatively stable…

Click here to get the full report.

This research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

|

|

|

|

Wednesday, April 29, 2020

Trovagene, Inc. is a clinical stage biotechnology company focused on the development of new therapeutics for hematology and oncology. The company’s clinical programs of Onvansertib (PLK1 inhibitor) include Phase 1b/2 study in AML, Phase 1b/2 study in mCRPC and Phase 1b/2 trial in KRAS-mutant colorectal cancer.

Cosme Ordonez, MD, Ph.D., Senior Life Sciences Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Trovagene’s lead drug effective in 88% of mCRC patients. The company yesterday released interim results from a Phase Ib/II clinical trial on the use of onvansertib for the treatment of metastatic colorectal cancer (mCRC) patients carrying KRAS mutations. Onvansertib is a first-in-class, third generation highly selective inhibitor of PLK1. In the trial, 7 out of eight patients (88%) responded to a drug treatment combination.

Data was presented at AACR 2020 Annual Meeting. The results were presented by Dr. Afsaneh Barzi at the American Association for Cancer Research (AACR) conference. Dr. Barzi was the principal investigator of the study. She is an associate professor of clinical medicine at Keck School of Medicine of USC and medical oncologist at…

Click here to get the full report.

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

|

|

|

|

Wednesday, April 29, 2020

Pyxis Tankers Inc is a United States-based international maritime transportation company which focuses on the product tanker sector. It owns a fleet which comprises of double hull product tankers employed under a mix of short- and medium-term time charters and spot charters. The fleet owned by the company includes Pyxis Epsilon, Pyxis Theta, Pyxis Malou, Pyxis Delta, Northsea Alpha, and Northsea Beta. Each of the vessels in the fleet is capable of transporting refined petroleum products, such as naphtha, gasoline, jet fuel, kerosene, diesel, fuel oil, and other liquid bulk items, such as vegetable oils and organic chemicals.

Poe Fratt, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Floating storage demand is boosting near-term refined product tanker market outlook. Global crude oil and refined product demand has dropped sharply due to measures to curb the Coronavirus and onshore storage capacity is filling up. The net result is higher demand for floating storage. Initially, crude oil tankers were positively impacted, but traders/marketers are looking for refined product tankers for storage of refined products to take advantage of attractive market conditions. As a result, the near-term outlook for MRs has improved markedly and TCE rates are moving higher. While it is difficult to predict when floating storage demand moderates and inventory destocking will ramp up, the long-term fundamentals remain attractive due to a shift in refining capacity in the eastern hemisphere and a limited order book (at the lowest level since 2000).

Maintaining 2020 EBITDA estimate, but positive surprises could materialize. Our 2020 EBITDA estimate remains at $6.9 million based on TCE rates of $13.5k/day and 1,589 operating days. Two one-year options recently expired so now all of the MRs are slated to reprice in 2Q2020; the Malou and Theta over the next month and the Epsilon in late June after a special survey. Operating leverage is high and each $1,000/day increase on the three MRs equates to EBITDA of $0.5 million over 2H2020. Due to Coronavirus related admin disruptions, 1Q2020 operating results could be pushed out into…

Click here to get the full report.

This research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

|

|

|

|

Wednesday, April 29, 2020

Salem Media Group is America’s leading radio broadcaster, Internet content provider, and magazine and book publisher targeting audiences interested in Christian and family-themed content and conservative values. In addition to its radio properties, Salem owns Salem Radio Network, which syndicates talk, news and music programming to approximately 2700 affiliates; Salem Radio Representatives, a national radio advertising sales force; Salem Web Network, a leading Internet provider of Christian content and online streaming; and Salem Publishing, a leading publisher of Christian themed magazines. Salem owns and operates 115 radio stations, with 73 stations in the nation’s top 25 top markets – and 25 in the top 10. Each of our radio properties has a full portfolio of broadcast and digital marketing opportunities.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Q1 likely to be disappointing. Total company revenues is estimated to be $58.29 million and adj. EBITDA from continuing operations of $4.79 million. We believe that the company did not aggressively reduce costs as the pandemic unfolded and is positioning to benefit from US government programs to support small businesses.

Challenging Q2. Quarterly revenues are expected to decline 22.5% to $50.1 million with cash flow (adj. EBITDA) expected to turn negative to $3.8 million. The company is expected to perform better than many of its media peers due to its relatively stable…

Click here to get the full report.

This research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

|

|

|

|

Wednesday, April 29, 2020

Pyxis Tankers Inc is a United States-based international maritime transportation company which focuses on the product tanker sector. It owns a fleet which comprises of double hull product tankers employed under a mix of short- and medium-term time charters and spot charters. The fleet owned by the company includes Pyxis Epsilon, Pyxis Theta, Pyxis Malou, Pyxis Delta, Northsea Alpha, and Northsea Beta. Each of the vessels in the fleet is capable of transporting refined petroleum products, such as naphtha, gasoline, jet fuel, kerosene, diesel, fuel oil, and other liquid bulk items, such as vegetable oils and organic chemicals.

Poe Fratt, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Floating storage demand is boosting near-term refined product tanker market outlook. Global crude oil and refined product demand has dropped sharply due to measures to curb the Coronavirus and onshore storage capacity is filling up. The net result is higher demand for floating storage. Initially, crude oil tankers were positively impacted, but traders/marketers are looking for refined product tankers for storage of refined products to take advantage of attractive market conditions. As a result, the near-term outlook for MRs has improved markedly and TCE rates are moving higher. While it is difficult to predict when floating storage demand moderates and inventory destocking will ramp up, the long-term fundamentals remain attractive due to a shift in refining capacity in the eastern hemisphere and a limited order book (at the lowest level since 2000).

Maintaining 2020 EBITDA estimate, but positive surprises could materialize. Our 2020 EBITDA estimate remains at $6.9 million based on TCE rates of $13.5k/day and 1,589 operating days. Two one-year options recently expired so now all of the MRs are slated to reprice in 2Q2020; the Malou and Theta over the next month and the Epsilon in late June after a special survey. Operating leverage is high and each $1,000/day increase on the three MRs equates to EBITDA of $0.5 million over 2H2020. Due to Coronavirus related admin disruptions, 1Q2020 operating results could be pushed out into…

Click here to get the full report.

This research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

|

|

|

|

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

The War Against Coronavirus

The outbreak of the novel coronavirus disease COVID-19 rapidly spreads around the globe. The various biotechnology firms, scientists, and physicians have been racing to understand this new virus and the pathophysiology of this disease to uncover possible treatment regimens and discover effective therapeutic agents and vaccines. Selected treatment options are highlighted below.

The current treatment options

Antiviral drugs destroy the virus by targeting and inhibiting the viral replication. Various drugs and approaches -including generic antimalarial drugs, novel drugs, and repurposed drugs that were intended to treat similar viral diseases- are being investigated to find an effective treatment for COVID-19The World Health Organization (WHO) recently started the solidarity program to test four existing therapies. The program is an international clinical trial to help find an effective treatment for COVID-19. The trial will compare four treatment options against the standard of care, to assess their relative effectiveness against COVID-19. The trial is evaluating

These drugs are also being investigated in separate clinical trials worldwide. Among all the antiviral agents that are under investigation, Gilead’s remdesivir is the most advanced in the clinic. In a study published by NEJM, Gilead reports that in the compassionate study with 53 patients the drug resulted in the clinical improvement of 68% of these patients. However, the study result included small number of patients, and there was no randomized control group to compare against. On April 16th, The University of Chicago Medicine reported that it had recruited 125 people with COVID-19 into Gilead’s two Phase 3 clinical trials. Of those people, 113 had severe disease. All the patients have been treated with daily infusions of remdesivir with nearly all patients discharged in less than a week and there were only two deaths. Placebo controlled Chinese trial data suggested no significant improvements in fatality of patients. Among 158 patients (79 in the control arm), 13.9% of the remdesivir patients had died compared to 12.8% of patients in the control arm after 1 month of treatment. Reports suggest that Gilead will present additional data from the first 400 patients in the trial with severe symptoms in May.

These drugs are engineered to trigger the immune system to attack the virus. A plethora of companies are pursuing this approach.

This group of treatment is charged with controlling the increased immune response known as the cytokine storm. Clinical evidence suggests that a frenzied immune response in COVID-19 patients make people severely ill or cause death. Several strategies are under investigation including cell therapies and small molecules.

This treatment method involves infusing COVID-19 patients with plasma from people who have recovered from the illness. The plasma is rich in antibodies that can fight Covid-19. Clinical studies are underway to evaluate this approach. A caveat of plasma therapy is that there isn’t enough plasma from recovered patients to treat a large patient pool.

Exhibit 1. Companies Developing Coronavirus Treatment

(Clinical/preclinical and alphabetical order)

Several

companies are pursuing programs to combat coronavirus as shown in Exhibit 1

including:

Antiviral

Cocrystal Pharma

Cocrystal Pharma is developing a protease inhibitor in collaboration with Kansas State University Research Foundation. Based on this collaboration Cocrystal Pharma will develop certain proprietary broad-spectrum antiviral compounds for humans to treat coronavirus infections. The company hopes to initiate preclinical studies in H2 2020.

Antibodies

CytoDyn

The acute respiratory distress syndrome (ARDS) of COVID-19 results from the accumulation of neutrophils within the pulmonary circulation and alveolar spaces. Leronlimab (PRO 140) inhibits the migration of Tregs into areas of inflammation, which can inhibit the innate immune response against pathogens and, most importantly, the migration of macrophages and release of pro-inflammatory cytokines in lungs. The CCR5 receptor appears to play a central role in modulating immune cell trafficking to sites of inflammation.

The company recently announced that it has treated the first patient with leronlimab, in a Phase 2b/3 study evaluating it in severe and critically ill COVID-19 patients. The study will evaluate the two-week administration of leronlimab in the patient population. The primary endpoint is the mortality rate at 28 days and secondary endpoint is the mortality rate at 14 days. The company plans to conduct an interim analysis of the data from 50 patients. The company will also evaluate leronlimab in a Phase 2b study in mild-to-moderate COVID-19 patients. CytoDyn has also administered leronlimab in about 30 patients, through hospitals and clinics, under Emergency Investigational New Drug (EIND) authorizations granted by the FDA. Data from patients under EIND has been promising. The first five patients with mild-to-moderate infection have been removed from oxygen. The data demonstrated that patients had encouraging immune restoration as well as a dramatic reduction in the critical cytokine storm after seven days of treatment. Particularly, restoration in the CD8 T-lymphocyte population, and a dramatic reduction in the critical cytokine storm cytokines IL-6, TNF-alpha. Patients are also benefiting from leronlimab treatment by being removed from external ventilation or extubated within seven days.

Humanigen

Humanigen is focused on preventing and treating cytokine storm with lenzilumab, the company’s proprietary Humaneered anti-human GM-CSF monoclonal antibody. Humanigen has announced that FDA has permitted to commence a Phase 3 study of lenzilumab in patients with COVID-19. Humanigen is developing a neutralizing, IgG1, monoclonal antibody against human GM-CSF, the upstream initiator of cytokine stress. Lenzilumab has demonstrated a sufficient safety and tolerability profile in other diseases, including severe asthma. Humanigen plans to enroll patients in a multicenter, randomized, placebo-controlled, double-blinded clinical trial with lenzilumab for the prevention of respiratory failure and/or death in hospitalized patients with pneumonia associated with COVID-19 in patients.

Nascent Biotech

Nascent Biotech’s lead product, pritumumab, is a fully natural human IgG antibody. Pritumumab is obtained by a proprietary technology from a B-cell isolation from a tumor-draining lymph node of a patient with cervical cancer. Pritumumab target is vimentin. Vimentin interacts directly with the coronavirus during its binding process to the non-infected cell and anti-vimentin antibodies can reduce the uptake of the coronavirus in pre-treated animals. Pritumumab is being studied to validate its inhibition of the virus to recognize, and therefore infect, the target cells.

Immune

Modulators

Can-fite

Can-Fite recently received approval to initiate a pilot clinical study of its drug candidate piclidenoson for the treatment of moderate-to-severe symptoms COVID-19 infected patients. It is also being evaluated in a multinational Phase 3 studies as a first-line treatment for rheumatoid arthritis, and as a treatment for moderate-to-severe psoriasis. Piclidenoson exerts its mechanism of action by modulation of key signaling proteins, such as PI3K, GSK-3?, PKA, PKB/Akt, IKK, and NF-kB, thereby de-regulating the Wnt and the NF-kB pathways. Consequently, this results in apoptosis of inflammatory cells.

The company is conducting a pilot trial that is a randomized, open-label, 2-arm study of Piclidenoson plus standard supportive care, compared to standard supportive care alone. Forty hospitalized COVID-19 infected patients with moderate-to-severe symptomatic disease will be randomized in a 1:1 ratio to one of the trial arms and will be treated for up to 4 weeks.

Capricor

Capricor reported earlier this month that two patients were treated in Los Angeles, California with infusions of CAP-1002. The company also reported that they plan to treat additional patients and submitted an expanded access Investigational New Drug (IND) application to investigate the use of CAP-1002 in certain COVID-19 patients. CAP-1002 consists of allogeneic cardiosphere-derived cells, or CDCs, a type of cardiac cell therapy that has been shown in pre-clinical and clinical studies to exert potent immunomodulatory activity and is being investigated for its potential to modify the immune system’s activity to promote cellular regeneration. The cells function by releasing exosomes that are taken up largely by macrophages and T-cells and begin a cycle of repair. CAP-1002 is also under clinical development for the treatment of Duchenne muscular dystrophy. In published pre-clinical data, the company reported that that CAP-1002 mitigates the release of anti-inflammatory cytokines as well as macrophage activation in several models of inflammatory diseases including sepsis and other autoimmune diseases. It is believed that COVID-19 induced ARDS pneumonia is a response to the cytokine storm and CAP-1002 could be a beneficial for the patients.

Cellular Biomedicine group

The Cellular biomedicine group is conducting a Phase 1 single-arm design, open-label, combined interventional clinical trial, to explore the safety and efficiency of exosomes derived from allogeneic adipose mesenchymal stem cells (MSCs-Exo) treatment for severe patients hospitalized with novel coronavirus pneumonia (NCP).

MediciNova

MediciNova will initiate clinical studies to investigate its drug, ibudilast (MN-166), to ARDS associated with Covid-19. The study will be conducted in collaboration with Yale’s Advanced Therapies Group. Ibudilast’s exerts its mechanism of action by inhibiting macrophage migration inhibitory factor (MIF) and phosphodiesterase (PDE) -4 and -10. In doing so it also inhibits pro-inflammatory cytokines and promotes neurotrophic factors. Furthermore, in previous human studies ibudilast demonstrated a significant decrease in serum MIF levels. Ibudilast’s anti-neuroinflammatory and neuroprotective actions were shown in previous clinical studies.

Pluristem

Pluristem recently successfully treated one patient with PLX cells in the United States under the compassionate use program. Prior to this, the company reported 100% survival rate for all seven high-risk patients under treatment from their compassionate use program in Israel. Furthermore, of the 6 patients that completed one week follow up, 4 of the 6 (66%) patients demonstrated improvement in respiratory parameters and 3 of the 6 (50%) patients were in advanced stages of weaning from ventilators.

PLX cells are allogeneic mesenchymal-like cells that have immunomodulatory properties that induce the immune system’s natural regulatory T cells and M2 macrophages, and thus may prevent or reverse the dangerous overactivation of the immune system. Therefore, PLX cells may potentially reduce the incidence and or severity of COVID-19 pneumonia and pneumonitis. Pluristem’s main target is to initiate a multinational clinical trial as soon as possible for PLX cells in the treatment of patients suffering from complications associated with COVID-19.

Suggested Reading:

Vaccine

Status – Which Companies are in What Stage

Post Pandemic

Stock Market Investing

Where

Investors Found Double-Digit Growth in Q1

Register for Channelchek Premium Content and Tools at No Cost!