Why the Current 60/40 Investment “Wisdom” Could Ruin Advisory Businesses

Whether you’re a

fiduciary investing assets for others, or a self-directed investor trying to

balance portfolio risk, when managing toward the classic 60/40 pie chart, you

may now require more active ingredients.

Prime Prospecting

for New Business

During tax season, people’s minds turn to their finances. This happens, of course, because most of us are making plans to settle-up with the IRS. Our financial papers are already in-hand, so it’s the most opportune time of the year to reevaluate our spending, retirement savings, new purchases, and investment portfolios.

This causes tax-time to be the “busy season” for financial advisors of all stripes — Accountants, RIAs, CFPs, Securities Brokers, and even Mortgage Lenders experience an increase in activity. The increased attention on money from January through mid-April is “celebrated” by advisors as prime prospecting time – Thank you, Internal Revenue Service!

Registered Investment Advisors, specifically, find business growth to be easier during this time of year. Households are looking for answers, this leads to conversations about their assets. People have been “trained” to take advantage of the tax incentives for individuals to shelter assets in deferred retirement accounts. These “qualified” vehicles, along with a 4/15 deadline, promote a surge in market activity. For an advisor’s current clients with an IRA, SEP, or other plan, contributions expectedly flow in as their current clients regularly add to their existing accounts. There’s also an increase in opportunities to meet motivated prospects. These people are usually do-it-yourselfers that realize they may be better off if they listened to informed advice. Or, a dissatisfied client of another firm that is looking to find a planner that may serve them better. Either way, Financial Advisors see a wave of new money.

How is New Money

Allocated

What’s done with this new money? The Employee Benefit Research Institute (EBRI) database collects information from a wide range of IRA-plan administrators. Their database contains information on 24.2 million accounts owned by 19.1 million individuals, with total assets of $2.36 trillion. It’s a large enough sample size to ensure a high confidence level when evaluating IRA investment habits, contribution size, rollovers, withdrawals, age information, and asset allocation. For the purpose of the strategies discussed in this “opinion piece,” we’ll focus primarily on asset allocation.

The EBRI research shows that the average IRA account assets are invested 60% stock and 40% fixed income, regardless of age. Also, the $2 trillion-plus “managed” in target-date fund investments is 60/40 at the target date. 60/40 has become the magic ratio that few savers question.

Conventional wisdom is like that. There are many axioms, especially related to money management, that are unquestioned and accepted as absolute truths.

Examples:

You get what you pay for.

Past performance is not an indicator of future returns.

The trend is your friend.

Buy low sell high.

Did you find anything wrong with these? Let’s look for a moment at the last two on this list. As much as they are often repeated, as it turns out, they completely contradict each other. The second on the list is a quick disclaimer appearing at the end of almost every investment brochure. Most of these brochures, when you read them, just finished using past performance to demonstrates the probabilities of a future result. So, they don’t seem to really want you to believe the warning. As for the first, “You get what you pay for,” well if earning higher returns was as easy as finding a more expensive investment method, selection would be easy. Or, as I sit here looking up at the online Channelchek research platform, which doesn’t cost users a dime for top-caliber research reports, I can see that argument has been discredited as well.

Can I also punch holes in the 60/40 ratio? Of course. It is inconceivable to me that “one size fits all.” Every investor has unique objectives, risk preferences, and risk capacity. A 65-year old with a pension designed to fully support them for as long as they live has a very high-risk capacity as it relates to their investments. Their preference for risk, however, may be that they’d prefer not to lose a cent — Even if the reward could mean tripling their money. When managing investments that are owned, coupled with a sufficient pension, you could actually maximize risk; the retiree’s capacity to endure a big loss exists. You can also risk nothing, earning nothing will not hurt the retiree either. It’s a decision that is purely personal to the investor. Age doesn’t come into play. In this case, I can argue that suitability may be viewed as what is preferred, not what others do at this life stage.

How about a much younger person? 30-somethings of any income level are likely to have a less certain future than the retired person with a large life pension, if for no other reason than because they have a longer future, which is harder to predict. So younger savers have less certain future needs than someone older. It is, however, easier to predict what the average returns could be within asset classes or sectors within that class with a longer time horizon. Most forecasters would rather predict expected return looking out decades rather than months. Why? Ask yourself this, “will the stock market be higher or lower 20 years from now?” The expectation is that it will be higher. So, at least we have a direction. Now ask, “will the stock market be higher or lower tomorrow, next week, next month?” With a longer time horizon, what may happen within an asset class is more predictable. Within sectors of the class, one can even project expectations of which will outperform or underperform other sectors.

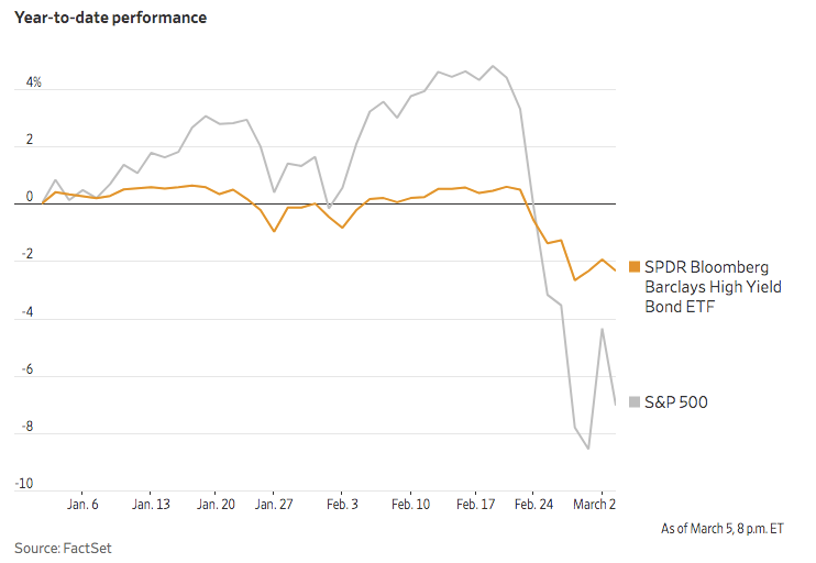

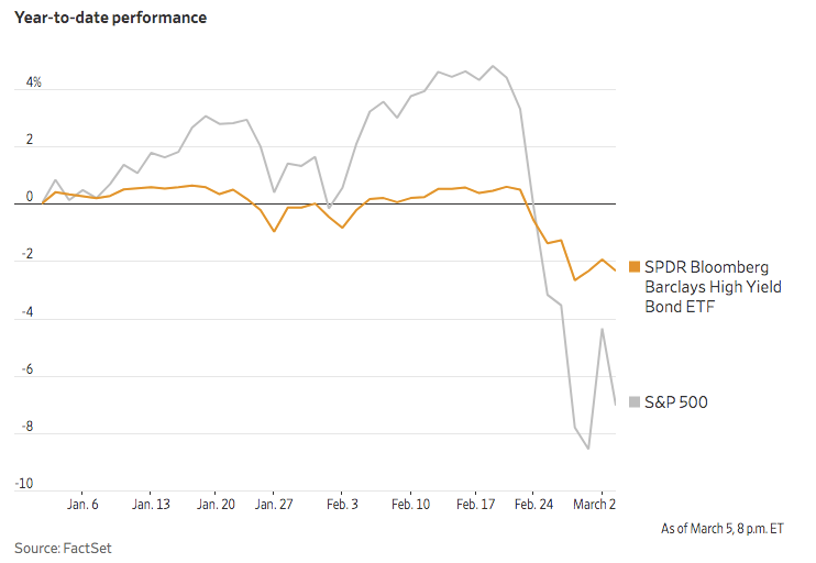

The 60/40 portfolio rationale was somewhat based on stock and bond prices moving in opposite directions, with bonds expected to be the lower performers. Within the bond or fixed income allocation, longer maturities have done better (rewarded investors for the additional risk). High yield bonds have also been statistically better performers than high-grade issues. They do, of course, add risk. The risk-adjusted return profile is such that it may make more sense to use part of your equity allocation to buy these below investment grade securities to achieve the best mathematical benefit. The Vanguard funds published a lengthy analysis of this subject in June 2019. I’ve provided the link below. Although troubled equity markets are usually related to economic forecasts, which also put downward price pressure on below-investment-grade bonds, the price declines have historically been tempered relative to stocks. The chart below demonstrates how stocks versus high yield bonds performed during the current record-breaking point declines this year in stocks. In either case, it is why diversified investors have fixed income in their portfolios, and why a core position in high yield bonds should be considered. Even if that position means reducing the percent equity held (not other fixed income). Proper balance by diversifying should be within the desired risk tolerance, and probable outcome projections, not a one size fits all standard.

Interest rates are currently at record lows for Treasuries. As I write this, the 10-year note has dropped to 0.75%. This severely limits (unless yields become negative) the amount of price appreciation one might expect in Treasuries. While Treasury prices are up, the spread between high grade and lower grade bonds has widened. Or put another way, the price-performance has been better in Treasuries than high yield, better in high yield than the S&P 500 average. As new IRA money is invested, attention should always be paid to the long term prospects of the asset classes that have done well and those that have done poorly. Can they be expected to reverse for a long-term investor?

The media would have us forget that the investment universe in equities is much larger than the Dow, S&P, or Nasdaq indices. Performance and risk balance should weigh the benefits of holding a core portion in Real Estate, then break that down into the various sub-categories looking at their performance. They should also weigh small-cap stocks and the expectations of the sub-sectors in this category. Diversification, by taking advantage of opportunities beyond the headline news of the major three indices, can have the effect of a better long-term portfolio that weathers the storm along the way. A thorough analysis comparing small-cap returns and performance is important before investing in the new IRA allocation or rethinking a retirement portfolio, it is beyond the scope of this article. John Hancock put out a useful report in February 2020. The link has been provided below.

“Robo-advisers are not nearly

as sophisticated as a live advisor, don’t throw that advantage away.”

60/40 Portfolio, There’s an App for That

As a general guideline, if you’re using a 60/40 allocation, you should consider further allocations within each asset class. Each of those will have its own performance characteristics and can be considered a core holding. New IRA contributions open the opportunity to strengthen diversification in this way.

If you’re an investment advisor and not determining how to best do this for each of your clients’ accounts, you may find over the next decade, you’re replaced by an app. This can be avoided. Humans are much better suited to determine risk profile, including the client’s tolerance for it. Humans are much better at hand-holding during declines in value. Selecting individual securities and not relying on funds is

a great way to differentiate yourself from today’s advisors who are still

behaving like index funds don’t have the potential for trouble. Robo-advisers

are nowhere near as sophisticated as a live advisor, don’t throw that advantage

away.

Everything Worthwhile Takes Work

Set it and forget it advisors will not last in this world where information is at everyone’s fingertips, and technology puts a trading floor in everyone’s pocket. Currently, anyone who can multiply by 0.6 can now invest in their favorite S&P ETF (or another major index alternative) and buy a medium-term corporate bond fund with the rest. Today this comes at approximately zero cost. For investors that are comfortable without real management, they can open an account and download the highest-ranked robo-advisor from bankrate.com or whatever their Google search turned up. Their returns will almost always beat an advisor who is charging them 1%-1.5% each year. An advisor who is looking within each asset class and managing sectors within the sectors will be offering a service that cannot easily be found in the Google PlayStore

If humans want to beat today’s average results, if advisors want to be more than just someone who helped fill out the forms, they need to think beyond the rules-of-thumb which stopped providing the best results.

We touched on a number of subjects without going too deep. Look for future publications on Channelchek where we’ll dig deeper in these areas

Paul Hoffman

Managing Editor

Suggested Reading:

The 2020s Could Become the Most Inclusive Decade for

Investors

Is Company Sponsored Research the Future for Small-Cap Stock

Investors?

The Nine Lives Investment Professionals Need to Survive the

New Decade?

Sources:

EBRI IRA Database: IRA Balances,

Contributions, Rollovers, Withdrawals, and Asset Allocation

Vanguard

Link on High Yield Bonds

John Hancock Link Small-Cap Stocks