|

|

|

|

Friday, March 13, 2020

Harte-Hanks Inc. (HHS)

Is The Company Out Of The Woods?

Harte-Hanks is a marketing services company that provides multichannel marketing solutions as well as consulting, data analytics, and strategic assessment. The company’s offerings focus on business-to-business, retail, finance, and automotive segments through digital, social, mobile, and print media offerings. Harte-Hanks strives to develop better customer relationships through its marketing and analytical services for clients. The majority of its revenue is derived from its marketing services in the retail, technology, and consumer brand segments.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Overachieves on cash flow. Q4 revenues were in line with expectations, but cash flow (adj. EBITDA) overachieves. Q4 revenues were $52.3 million versus our $52.0 million estimate. Cash Flow was $3.1 million versus our $800,000 estimate. The variance was partially attributed to better than expected insurance reimbursement.

Further realigning its businesses. The company plans to further reduced costs through renegotiating vendor agreements, eliminating low margin or unprofitable revenue, and consolidating facilities. Expenses are expected to decline at a faster pace than…

Click to get the full report.

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst

certification and important disclosures included in the full report.

NOTE: investment decisions should not be based upon the content of

this research summary. Proper due diligence is required before

making any investment decision.

The results are then shared to help uncover trends and to help support sound decision making. Not long ago, they concluded a study using 10,168 U.S. adults as part of a project on trust and research. The results of the study can be very useful as a basis to guide business marketing, personal branding, and sales of all types.

The results are then shared to help uncover trends and to help support sound decision making. Not long ago, they concluded a study using 10,168 U.S. adults as part of a project on trust and research. The results of the study can be very useful as a basis to guide business marketing, personal branding, and sales of all types.

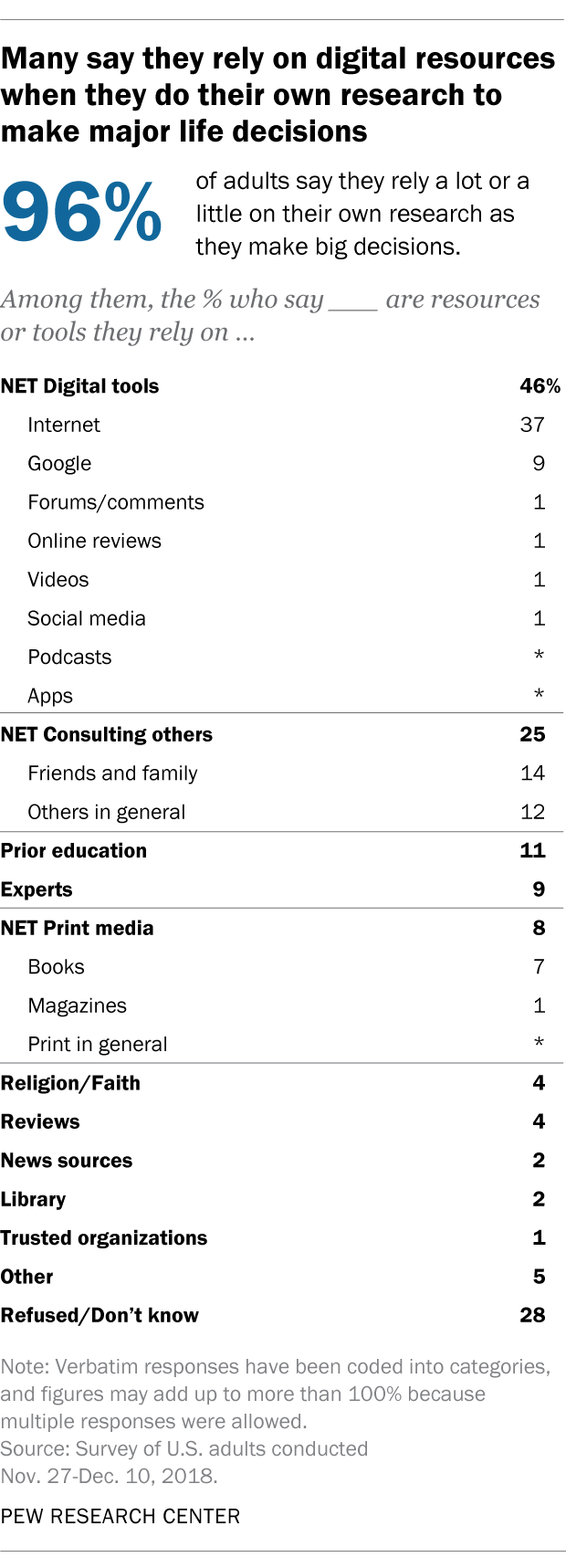

Of the combined 96% of respondents that said they rely on their own research to some degree, they were then asked to define what it is they do to gather trusted information. When answering this open-ended question, they cited many venues– they typically started with the internet. However, the internet was not the be-all-end-all for personal research. Overall, 46% explained they turn to online sources, while 25% said they sought advice from others they know. Fewer still relied on prior education, followed by print media, and religious or instinctive decision-making. As the overlapping statistics imply, it is common for people to use multiple means to choose a course of action.

Of the combined 96% of respondents that said they rely on their own research to some degree, they were then asked to define what it is they do to gather trusted information. When answering this open-ended question, they cited many venues– they typically started with the internet. However, the internet was not the be-all-end-all for personal research. Overall, 46% explained they turn to online sources, while 25% said they sought advice from others they know. Fewer still relied on prior education, followed by print media, and religious or instinctive decision-making. As the overlapping statistics imply, it is common for people to use multiple means to choose a course of action.