The ”Coronavirus Economy,” will Washington “Go Big?”

The health of the U.S. economy depends on in-person interactions among its citizens. Additionally, as a major global trading partner, it also relies on overseas economies with which to transact. At an increasing pace, over the last month, our trading partners have brought the pace of commerce down significantly. Both internally and externally, all “non-essential” transactions are at a crawl. In just the past two weeks, the subject of the coronavirus has gone from the punchline of jokes at the office watercooler to the reason people no longer use the office water cooler. There is now a semi-mandatory freeze on interacting with our co-workers, friends, neighbors, and service industry workers. We have brought the U.S. economy from its “90 mph pace” in February to a mid-March standstill. Unlike other slowdowns, we’re not out of gas. So, what can be done?

Sedate or

Stimulate?

The lack of transactions (economic activity) has been orchestrated and to one degree or another required. We are now in the midst of economic malaise. In the past, the tools for fighting economic malaise was lead by a targeted approach to cause banks to lend more, companies to hire more, or people to spend more. In the current situation it would seem that stimulus while forcing people and businesses to be less than simulative, is a lost cause.

The two opposing forces could turn out to be more costly than effective. The Federal Reserve Bank has slashed overnight bank lending rates to near zero over just a few weeks. Lower rates is their tool used to accelerate lending and the accompanying economic activity as it promotes increased spending and investment. It also helps, at least initially, banks who improve their profitability because they now have access to a cheaper cost of money against higher interest rate loans. The likelihood that slashing Fed funds to near zero will have the same impact as in the past seems very low. We are being incentivized to spend while urged to hunker down.

At the same time that the Fed announced its second rate cut of the year (only nine days after a very strong employment report), they also announced additional actions, which included buying $500 billion or more of U.S. Treasuries. Along with the Treasuries, they said they would purchase Federal agency mortgaged back securities totaling over $200 billion or more. The positive effect of the Fed buying securities in the open market on a wholesale level is twofold. First, it adds cash, in this case, over $700 billion, into the economy. Putting cash into the market in this way is the simulative practice dubbed quantitative easing during the 2008 financial crisis. Secondly, it lowers interest rates even further in that it dramatically increases demand on longer-term securities. The lower rates are intended to reduce the cost of money, allowing individuals and companies to borrow (and therefore spend) at a lower rate. Not unlike cutting Fed Funds, it is to promote activity — Activity that we are restricted or discouraged from taking part in. At the same time, it creates another problem, senior citizens, the age group expected to be most at risk to the coronavirus, depend on income generated from CDs and fixed income securities. The impact of the health crisis, especially to older people, and the reaction, has created another cause for problems to older people, income.

Old

Habits

Reason suggests that trying to sedate activity while at the same time stimulating it is like washing melatonin down with Red Bull to get a good night of rest. Both seem to work against each other. The government reaction to economic headwinds has always been to stimulate using the methods described above. This new problem has a completely different set of circumstances. The economy was breaking records in many categories just weeks ago. Yet now, the likelihood of a recession (two or more consecutive quarters of negative GDP) seems unavoidable. Under most predictions related to the guidance to minimize interacting with others, we will be crawling into mid-Summer.

The latest plans being discussed in Washington are also being called stimulus plans. Using “stimulus” to describe them may be out of habit, or to try to get them passed, but they are not intended to fire up the economy. Instead, the intention is to help bridge the needs of households until we can all get back to work. If government help is needed, bridging the gap and tending to the health issue until people can begin consuming again is a useful response.

Going Big

on a Bridge Plan

President Trump is determined to lead the country out of the health crisis while minimizing damage to citizens and the businesses that employ them. He had been discussing the idea of a payroll tax cut with his advisors. The payroll tax cut would help small businesses and individuals as long as the businesses remained open. This doesn’t help businesses that are not open. The people and businesses that will be most hurt by the dramatic downshift of the economy will be those without pay or payroll because they’re idle. Even companies that are open, with reduced business and workers with reduced wages, would have a long wait for the benefit of any payroll tax cut.

It was just announced that taxpayers have been given the flexibility of delaying 90 days to pay their taxes to the IRS. The White House has also asked for legislation to include support for small businesses and aid to the airline industry, and other measures for industries hurt by the slowdown. As it relates directly to households, U.S. Treasury Secretary Steven Mnuchin said they plan to put money in people’s hands now. His exact words are: “And when I say now, I mean in the next two weeks, not six to eight months under tax relief.”

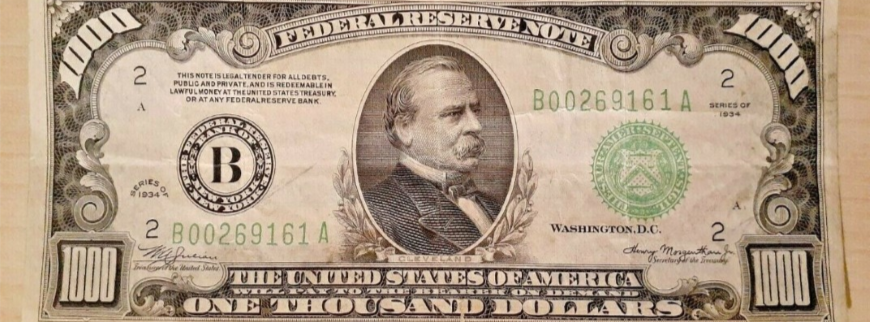

The most recent plan being discussed in the Senate and the Administration is a package from $1 trillion to $1.2 trillion which would include cash payments, loan guarantees, and a host of “kitchen sink” items designed to bridge business and their workers to the other side of this crisis. One of the most talked-about items on that list is a one-time payment of $1,000 to workers directly from the U.S. Treasury.

While we

Wait

Anyone in Washington delaying a plan that will help relieve people who are rightfully concerned for their financial security risks losing the next election. This is a time of national crisis, and there seems to be more of an air of unity, with only mild positioning. With this, we should begin to see “bridging” actions put into play.

For those stuck at home, finding your own way to bridge the gap before returning to your normal work environment, being as productive as possible will help. Strengthening your own infrastructure, whether that means Spring cleaning, or setting up an efficient home office will help your productivity now, and on the other side of the crisis.

If you own or are with a company that is still open but not at capacity, this may be the time to build on your own infrastructure. Look at the improvements that you can make to slingshot back up to speed when we are passed this. Depending on your business, a marketing plan may be in order to stay in front of customers and investors throughout. Your competition may be distracted by news events; this could be the best time to move forward and come out ahead

Suggested

Reading:

Bear Market Cycles, is it Different

this Time?

ZIRP and QE5

Sources: https://www.washingtonpost.com/us-policy/2020/03/17/trump-coronavirus-stimulus-package/

https://www.bloomberg.com/news/articles/2020-03-17/mnuchin-says-trump-wants-money-sent-to-americans-in-two-weeks