Noblecon16 — Panel is set to Discuss Recent Breakthroughs in Inflammasome Space

There is an ongoing renaissance in the potential for drugs targeting a unique inflammation hub, inflammasome. Inflammasomes are crucial to coordinate in?ammatory responses. Inflammation is a protective immune response to harmful stimuli, such as pathogens, dead cells or irritants, and is tightly regulated by the host. The innate immunity is the first line of defense in recognition of infection and initiation of clearance by the host. The activation of the inflammasome is a key function mediated by the innate immune system. Three main domains comprise inflammasomes: sensor molecule, adaptor protein (ASC), and effector protein mainly pro-caspase 1.

Oligomerization (generation of multi-molecular complex of inflammasome) is triggered by danger associated molecular patterns (DAMPs) or pathogen-associated molecular patterns (PAMPs) that results in effector activation and leading to maturation of procytokines and pyroptosis, a form of inflammatory cell death. The nucleotide-binding domain-like receptor (NLR) family is the main group of proteins considered as inflammasome sensors. Inflammasome sensor proteins are involved in the recognition of particular danger stimulus and then initiate the assembly of inflammasome multimeric complex. Among NLR family (NLRs—NLRP1, NLRP2, NLRP3, and NLRC4, nonNLRs—absent in melanoma 2 (AIM2) and pyrin), NLRP3 recognizes the largest array of stimulus and it is the most studied in terms of developing NLR inhibitors. The adaptor proteins are known as apoptosis-associated speck-like protein (ASC) containing a caspase activation and recruitment domain (CARD). In response to PAMPs or DAMPs, the sensor molecule recruits ASC, which recruits pro-caspase 1. This interaction converts pro-caspase-1 into its activated form, caspase-1. Caspase-1 then cleaves the proforms of IL-1ß and IL-18 into their mature forms, which triggers the inflammatory process, which can induce cell death via a process known as pyroptosis (Exhibit 1). The release of IL-1ß and IL-18 leads to the activation of several downstream pathways that further assist in the inflammatory process.

Exhibit 1. The inflammasome mechanism of action

Source:

Hoffman and Broderick, J Allergy Clin Immunol, 2016

While insufficient inflammation can lead to persistent infection of pathogens, excessive inflammation can cause chronic or systemic inflammatory diseases. Inflammasomes play a crucial role in mediating inflammation and therefore serve as potential drug targets for the treatment of inflammatory-mediated diseases. Inflammasomes have been associated with variety of autoinflammatory and autoimmune diseases, including neurodegenerative diseases (multiple sclerosis, Alzheimer’s disease, and Parkinson’s disease) and metabolic disorders (atherosclerosis, type-2 diabetes, and obesity). Currently, there are no approved inflammasome inhibitors; however, there are several early stage assets in the pipeline. While most companies are targeting the sensor molecule (NLRP3), some others are taking a unique approach targeting either the adaptor protein (ASC) or other molecules.

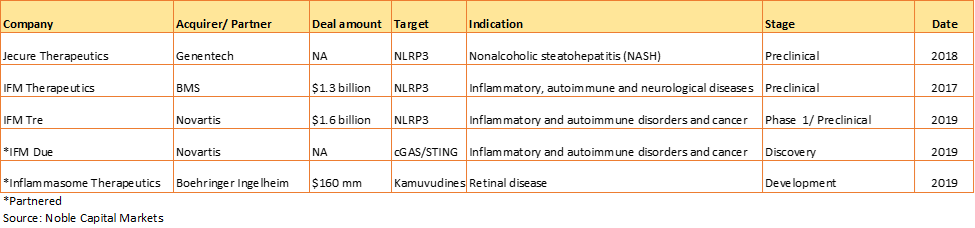

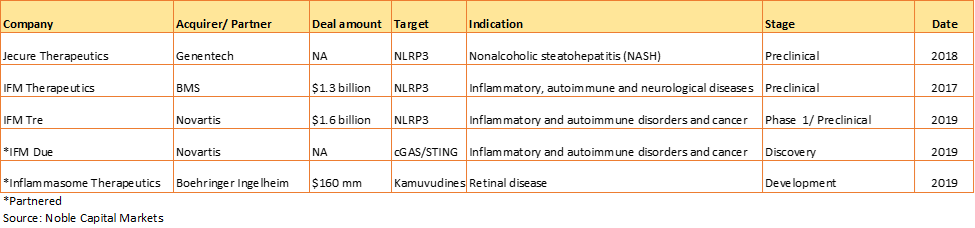

Exhibit 2. Recent selected deals in inflammasome space

At least, four biotechnology firms with NLRP3 inhibitors have been founded in the last four years. In 2018, they raised a collective $117 million in venture capital. Inflazome was recently granted over US$1M in funding from The Michael J. Fox Foundation for Parkinson’s Research (MJFF). High activity in inflammasome space was seen in the recent years. Among the multiple M&A and partnership deals, the majority of them were at preclinical stage. The transaction volume varied, $160 mm – $1.6 billion (Exhibit 2). Multiple acquisitions in the field show the first inflammasome target -NLRP3 -is gaining momentum. The question remains how fast the best set of indications can be identified from the sea of possibilities.

Selected Companies Targeting Inflammasome

Highlighted below the Inflammasome Panel

attendees and selected companies with current programs in inflammasome

therapeutics (alphabetical order).

Inflammasome Inhibitors: The Next Generation of

Innovative Immunotherapy Agents

Monday, February 17 – 10:00am – 11:00am – Terrace Ballroom B

- Paul Ashton, PhD., Co-Founder & CEO of Inflammasome Therapeutics, Inc.

- Gary Glick, PhD., Co-Founder & Executive Chairman of IFM Therapeutics and Michigan Professor of Chemistry

- Steve Glover, Co-Founder, President & CEO of Zyversa Therapeutics, Inc.

- Robert W. Keane, PhD., Professor Physiology & Biophysics, Neurological Surgery & Microbiology, and Immunology at the University of Miami, and co-founder of InflamaCore, LLC

- Clay B. Thorp, General Partner at Hatteras Venture Partners

IFM Therapeutics (Private

company)

IFM Therapeutics (IFM) is a Boston-based, a privately held biopharmaceutical company focused on developing novel therapies that regulate the innate immune system. IFM was formed following the acquisition of the original IFM Therapeutics by Bristol-Myers Squibb in 2017 ($1.3 billion). IFM has a unique approach in regulating the management of its research and development activities. IFM has separate subsidiaries that are responsible for a particular set of programs. While each subsidiary is financially independent, they share common infrastructure and resources. IFM has established three subsidiaries: IFM Tre was launched in July 2018 and was subsequently acquired by Novartis in May 2019, IFM Due, which launched in February 2019, and the most recent, IFM Quattro launched in Dec 2019.

IFM’s inflammasome platform is based on antagonists of NLR proteins for inflammation-mediated diseases (such as, Alzheimer’s, liver fibrosis/non-alcoholic steatohepatitis (NASH), and type 2 diabetes) and anti-cancer agents for modulating the tumor environment. IFM currently has two NLRP3 antagonists in the preclinical stage and one NLRP3 antagonist in Phase 1 for the treatment of inflammation, fibrosis, neuroinflammation. The rights of the above molecules belong to Novartis. IFM has another NLRP3 agonist, an anti-cancer agent, owned by Bristol-Myers Squibb.

Inflammasome Therapeutics

(Private company)

Inflammasome therapeutics is developing therapies for Alzheimer’s, multiple sclerosis, macular degeneration, and type 2 diabetes by averting unusual inflammasome activation. They have identified and licensed a series of molecules known as Kamuvudines. The company has presented and published favorable preclinical data and recently established partnership with Boehringer Ingelheim to co-develop up to three therapies for patients with retinal diseases. Based on the agreement, Inflammasome is entitled to receive up to $160 million in up-front, research and development support and milestone payments and royalties based on future commercial sales of the products.

Inflazome (Private company)

Inflazome is a clinical stage biotechnology company that specializes in developing a NLRP3 small-molecule targeting inflammatory mediated diseases. The company received a grant in October 2019 from The Michael J. Fox foundation for the development of a NLRP3-specific Positron Emission Tomography (PET) tracer to allow non-invasive imaging of inflammasome-driven inflammation in the brain. Inflazome also completed a $46 million Series B funding in 2018. Inflazome’s lead asset Inzomelid is a potent, selective, brain penetrant NLRP3 inhibitor that is currently in Phase Ib trials. Inzomelid is indicated for the treatment of neuroinflammatory and neurodegenerative diseases such as Parkinson’s, Alzheimer’s and Motor Neuron Disease as well as the orphan disease CAPS. The second is Somalix, a potent, selective, peripherally restricted NLRP3 inhibitor that is currently in Phase I trials indicated for the treatment of arthritis and cardiovascular diseases. Clinical trial data are not available at this time.

Nodthera (Private company)

Nodthera is an early-stage biopharmaceutical company developing novel NLRP3 inhibitors for the treatment of NASH, pulmonary fibrosis, neurodegenerative disorders, and inflammatory bowel disease (IBD). The company’s lead candidate NT-0167 is currently under pre-IND stage. Nodthera completed a $40 million Series A funding in 2018.

Zyversa Therapeutics, Inc (Private

company)

Zyversa is a clinical stage biopharmaceutical company developing first-in-class therapeutics for inflammatory (e.g., multiple sclerosis and NASH) and renal (e.g., diabetic nephropathy and lupus nephritis) diseases. Zyversa’s lead inflammasome targeting agent is IC 100, a monoclinal antibody targeting ASC for the treatment of multiple sclerosis. The company licensed IC 100 from InflamaCORE. Preclinical studies suggest that IC 100 inhibits the downstream inflammatory pathways. IC 100 is a nonspecific ASC inhibitor, which has a wide therapeutic range potentially inhibiting various types of inflammasomes. Zyversa has three additional ASC inhibitors under development for Lupus Nephritis, NASH, and diabetic kidney disease.