|

|

|

|

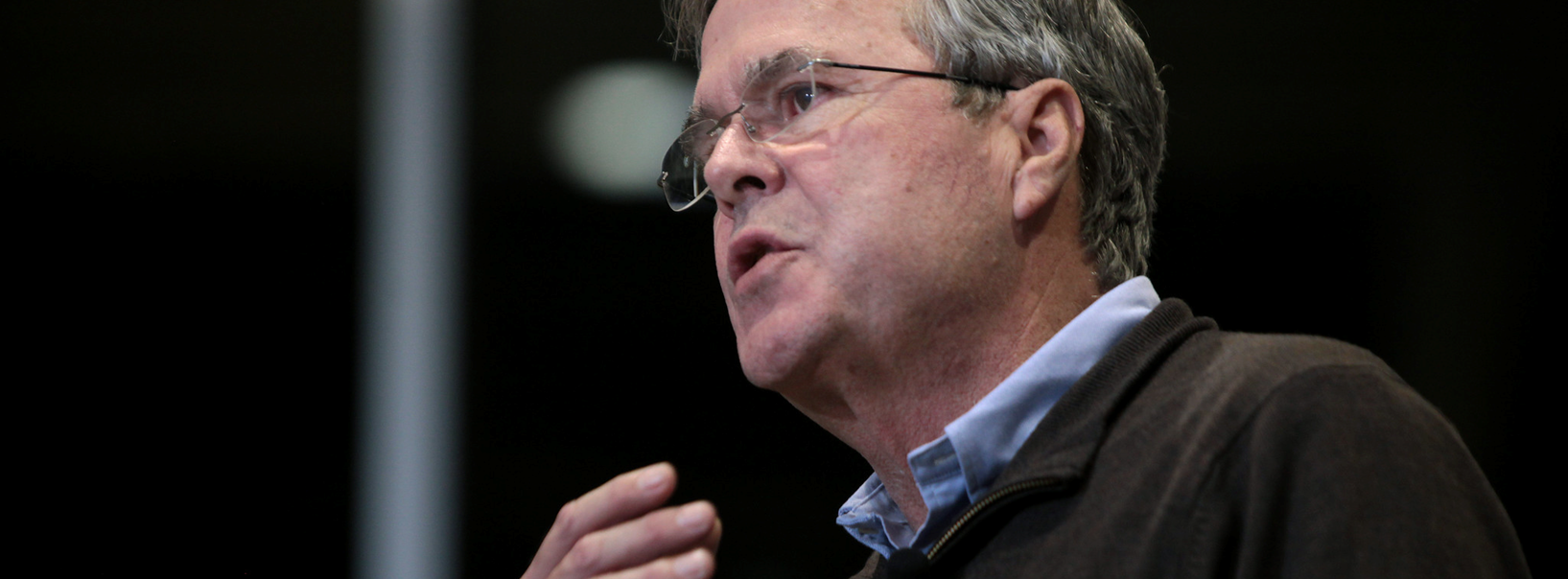

Jeb Bush to Present at NobleCon16 Investor Conference

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

Presidents Day 2020, Jeb Bush, Governor of Florida (1999-2007) will provide the opening address at Noble Capital Markets annual investor conference, NobleCon16. Bush’s keynote address on Monday, February 17, should offer a unique perspective on the upcoming election, along with current business and economic topics.

During his eight years as Governor, Bush became known for his pro-business, low-tax position. He reduced taxes by $19 million, cut the size of Florida’s state government by 6.6% and vetoed $2 billion in new spending. During that time the state’s reserves grew from $1 billion to $10 billion, resulting in Florida being the only state from 1999-2007 to be upgraded to AAA by analysts at S&P. “NobleCon offers family offices, self-directed investors, investment advisors and institutional investors direct access to America’s most important asset: emerging growth companies,” said Bush. “These are the companies that represent breakthroughs in technology, science and medicine. I’m looking forward to being a small part of this important conference.”

The conference is open to investors, including, institutions family offices, investment advisors, hedge funds, equity analysts, private equity & venture capital firms, independent brokers, wealth managers, and self-directed investors. Information for those wishing to attend can be found on the NobleCon conference

website.

His keynote address is one of many important announcements Noble has been making concerning NobleCon16. Additional “in-the-know” presenters and the details of six different panel presentations with topics such as; Oncology, Inflammasomes Immunotherapy Agents, Type 1 Diabetes, Precious Metals Exploration, International Transportation & Logistics, and others.

Should you attend NobleCon16?

If you’re a Channelchek user, you already have an interest in discovering more about the types of companies that will be represented at NobleCon16. NobleCon conferences experience 70% repeat attendance by investors who want to build on their understanding of opportunities and perhaps meet privately with company management to best understand potential. If you’re a money manager, family office, financial services provider, self-directed investor, or equity analyst, you are likely to learn of companies, products, and breakthroughs you could easily miss in a world where larger household name companies get the majority of the spotlight. Some of tomorrow’s household names are companies that benefit from more light being shed on them today. That’s what NobleCon and ChannelChek are about, shedding more light on small and microcap opportunities — unearthing actionable ideas.

More Information:

https://noblecapitalmarkets.com/news/jeb-bush-noblecon

Photo Courtesy of: Gage Skidmore