Thursday, October 10, 2019

Media Industry Report

Is The Sell-Off Over?

Michael Kupinski, DOR, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to end of report for Analyst Certification & Disclosures

- It’s Tough Being A Media Stock.

Concerns over the strength of the general economy has weighed heavily on media stocks, which typically perform poorly in a late stage economic cycles. The stocks of debt heavy companies have felt the brunt of the lack of investor interest. Is it time to buy? Will the upcoming elections outweigh concerns over the economy?

- Radio: Repairing balance sheets. The Radio industry is reeling (down a significant 44% over the past 12 months) as investors shy away from highly levered radio stocks. Can the industry recover?

- TV: Apollo’s mission.

The private equity group recently purchased Cox Enterprises TV stations and now indicated interest in TEGNA. It is not surprising that it needs to get bigger. But, the sign of continued industry consolidation did little to bolster TV stocks, which under performed the general market. What’s next for TV?

- Publishing: Will it last?

The Publishing stocks outperformed the general market in the last twelve months and year to date, bolstered by the prospective merger between New Media and Gannett. This market cap weighted index, however, masks some of the more problematic stocks in the industry.

- Digital Media: Hitting a speed bump.

The third quarter of 2019 was a difficult quarter for the market in general and for three of Noble’s four internet and digital media sectors.

Click ‘view previous report’ for company specific disclosures on Noble covered companies.

Overview

It’s Tough Being A Media Stock

Concerns over the strength of the general economy and fears of an economic downturn weighed heavily on media stocks. Most media stocks have under-performed the general market over the past 12 months and year to date, as detailed in this report. (Deal stocks are largely the only stocks that have out-performed.) The under-performance is somewhat typical in a late stage economic cycle for consumer cyclicals like Media stocks. But, are investors too early on betting on an economic downturn? It is easy to see why investors are skittish. The economic recovery has now entered record territory, 123 months. The previous longest economic recovery was 120 months from March 1991 to March 2001.

Slower growth has added to the concerns over the economy. The economy was growing a healthy 3.1% in the beginning of the year and economists are predicting that GDP will increase a more modest 1% to 1.5% in the second half of 2019. A more modest 1% GDP growth will feel like an economic downturn after a 3.1% report earlier in the year. The curious question, however, is the affect of a slower growth economy on the upcoming third quarter results and the outlook in the fourth quarter. In our view, management teams likely will be somewhat cautious about the advertising environment heading into the fourth quarter. But, we would note that the economy is still healthy. In addition, it appears that many media stocks are over sold, with stock valuations trading near recession type valuations. Furthermore, we believe that investors will begin to focus on an improved advertising environment in 2020, fueled by Political advertising. While we are constructive on many media stocks, we encourage investors to be selective and opportunistic. The prospect of a third quarter “miss” or lackluster fourth quarter outlook, may provide a better buying opportunity.

Television Broadcasting

Apollo’s Mission

The private equity group purchased a majority interest in Cox Media Group for $3.1 billion earlier in the year. The Cox Group includes 14 television stations that cover 6.0% of the nation’s TV households, which includes the UHF discount rule. It is not surprising that Apollo has already set its sights on its next target, TEGNA (view previous report). News reports indicate that Apollo expressed interest in TEGNA even while it was pursuing the Cox stations in February. The consolidation wave in the television industry is fueled by the need to scale as a counter weight in negotiations with the cable providers and the Networks.

A potential merger with TEGNA, which currently covers roughly 31.8% of the nation’s TV households, including the UHF discount rule, would put a potential merger very near the current ownership cap of 39%. In total, excluding the UHF discount rule, the combined company would cover roughly 50% of the nation’s television households. This would allow the new company to join the ranks of a super broadcast peer group, including Nexstar and Sinclair, and provide sufficient negotiating leverage. We believe that Apollo needs to do a deal. Otherwise, its relatively small broadcast group will suffer, as many small broadcast groups have, without enough leverage to negotiate favorable Retransmission deals with the cable operators and with the Networks, which are clawing back more of the Retrans revenue.

Aside from this potential deal, where do we stand with industry consolidation? The prospect of a raise in the ownership cap is unlikely. The FCC does not appear to have the will or the leadership to accomplish this, especially given the Democratic controlled House, which likely would have some say on the potential increase. Consequently, we are likely stuck with the 39% cap. There are still deals to be done for some broadcasters to reach that cap. However, large deals (aside from the potential TEGNA deal) will be few and far between. Nonetheless, there appears to be room for one or two more super broadcast groups to emerge from the remaining TV stations and smaller groups. A potential combination of some of the remaining groups under the ownership caps include: E.W. Scripps (view previous report), Meredith, Graham Holdings, and Hearst, for instance.

It is obvious, however, that the industry is in the seventh inning stretch of its consolidation wave. Signs of continued industry consolidation from news about Apollo did little to bolster TV stocks overall and the sector under performed the general market. Over the past 12 months, the Noble Television Index is down 8.3% versus a 2.1% increase for the general market, as measured by the S&P 500 Index. Even the year-to-date performance is uninspiring, up 7.7% versus an 18.7% increase for the S&P 500. What is disappointing about this performance is that it was largely driven by the larger cap stocks in the index, including Nexstar up 19.9% for the year, Sinclair, up 45% and TEGNA up 30%. So, what is happening? The rest of the smaller cap broadcast stocks performed poorly, with E.W. Scripps down 22%, and others like Entravision and Gray Television (view previous report), roughly flat for the year. It is the tale of the haves and have nots. Investors appear to want to own Television stocks heading into the election cycle, but want liquidity in case the outlook turns sour. At this time, we find value in the smaller cap names and would focus on our favorites E.W. Scripps, Entravision (view previous report), and Gray Television.

Radio Broadcasting

Repairing Balance Sheets

The Radio industry is reeling, down a significant 44.8% over the past 12 months and down 21.9% year to date. In comparison, the general market as measured by the S&P 500 Index is up 2.2% and up 18.7%, respectively. We believe that investors have shied away from the sector given its relatively small size, lack of liquidity for large institutional investors, and high debt leverage. One of the largest market cap stocks and arguably one of the leaders in the industry, Entercom, is a relatively small $440 million in market cap. Entercom does have decent trading volume, however, on average 1.5 million shares a day.

The high debt leverage in the industry is a problem. Investors have long memories from past economic cycles whereby a number of radio companies declared Chapter 11 and/or recapitalized in the economic downturns in 1991 and in 2000. Most recently, iHeart Media and Cumulus Media recapitalized. The aversion to high debt leverage is reflected in such stocks as Salem Media (view previous report), down 37.8% for the last quarter and year to date. The company’s debt leverage to our estimated cash flow rests at 6.6 times.

Radio management teams are trying to avoid recapitalizations by aggressively tackling their debt through asset sales, asset swaps to improve efficiencies and cash flow, and aggressive use of free cash flow to pare down debt. Cumulus Media is a good example of a company managing its station portfolio to maximize its cash flow and aggressively pare down debt. The company announced a voluntary debt payment of $50 million in the latest quarter, which followed some station sales and asset swaps. As a result, the CMLS shares are among the few stocks that are up year to date, up 19.2%, and actually out performed the market on a comparable year to date basis.

In addition, radio companies are seeking revenue growth vehicles. One area that the radio industry is becoming more active in is Podcasting. The CEO of iHeart Media, Bob Pittman, stated at a recent industry conference that “we think of podcasting as an extension of radio.” Notably, Podcasts have been around since 2004. Yet, for many years podcasting failed to elicit the same excitement as its video counterpart, streaming video or over-the-top TV (OTT). Just as video viewing has migrated from linear TV to video-on-demand, so too has audio listening moved from live/linear to on demand listening. History will probably look at 2019 as the year that podcasting graduated to the big leagues. We see three driving factors behind that change.

The first driver is consumer adoption at scale. It is hard to walk down the street and not see people with ear buds in the ears. Consumer adoption of online audio has reached scale with 189 million listeners or 67% of the total 12+ population listening to streaming audio each month. Nielsen reports that the average person 18+ listens to an hour and a half of streaming audio each week. Podcasting has also reached something of a tipping point, with Edison Research reporting that 51% have listened to a podcast, 33% of the 12+ population (90M people) have listened to a podcast in the last month, and 22% of the U.S. population listens each week.

The second driver is advertiser acceptance. Until recently podcast advertisers primarily consisted of direct response advertisers. 2019 appears to be the year in which brand advertisers began to adopt the platform at scale. There are several reasons for this: 1) podcast listeners hear live ads made personal from their favorite hosts; 2) podcast ads are native and integrated seamlessly into the show; 3) listeners pay attention to podcast ads (they don’t skip ads and their brand recall is higher than other mediums); 4) listeners buy products from podcast ads (according to podcaster Midroll (owned by E.W. Scripps), 63% of podcast listeners have bought a product they heard on a podcast); 5) podcast listeners are an attractive demo: young, educated, and affluent.

For these reasons, eMarketer forecasts podcast advertising to grow to more than $1 billion in 2021, up from $479 million in 2018, representing a 3-year CAGR (compound annual rate) growth of 30%. In 2019 alone, podcasting is projected to grow by more than 40%. Not bad for a medium that has been around for 15 years.

Finally, Spotify has almost single handily brought the sector to the forefront, having announced several acquisitions as part of its plan to become the world’s leading audio platform. Spotify sees audio as only 1/10th the market size of video, representing a huge upside, but it also believes over time podcasts will represent 20% of all of Spotify’s content. Spotify states that its podcast listeners are nearly twice as engaged as non-podcast listeners on their platform. Spotify’s goal is to provide the best content, the best discovery and the best user experience for consumers.

A look at recent podcast M&A transactions shows that in addition to Spotify, a handful of radio companies, including Entercom, iHeart and Rogers Media have gotten in the game as well. We expect continued M&A activity in podcast industry, as it pertains to both podcast content creators as well as software companies that provide the tools to create and distribute podcasts.

While radio players may seek podcasts as a growth vehicle, another company has gained investor attention through its compelling growth in its Digital Media divisions and beat the odds for the poor industry stock performance. In spite of Townsquare Media’s relatively high levels of debt, the company has been growing revenues and cash flow due its strong Digital Media performance. As such, the TSQ shares bucked the industry trend and is up a solid 23.5% for the year to date, beating the general stock market. We expect continued strong performance from the company’s Digital Media businesses, which likely will allow the company to have above average industry performance in revenue and cash flow growth. Like many in the industry, the company is using its free cash flow to aggressively pare down debt.

We believe that there is time to repair balance sheets given that an economic downturn does not appear imminent. In addition, many in the industry appear to be looking toward growth oriented businesses as a means to improve their investment profile. As such, we believe that many of the stocks that are currently out of favor have significant upside potential based on the prospect of debt reduction, like Salem Media. In addition, in spite of the above average stock performance, we continue to favor Townsquare Media (view previous report), given the prospect of a revaluation of its shares to reflect its fast growing Digital Media businesses.

Publishing

Will it last?

The Publishing stocks outperformed the general market in the last twelve months and year to date, bolstered by the performance of the leadership stock in the group, New York Times, which was up 23% year to date. The Index is market cap weighted and, as such, the New York Times $4.7 billion market cap significantly skewed the industry performance. The Publishing Index was also buoyed by the prospective merger between New Media and Gannett, $1.2 billion market cap. The Gannett shares are up 18.1% year to date.

This market cap weighted index masks some of the more problematic stocks in the index, such as The McClatchy Company (view previous report), down 61.6% and Tribune Publishing (view previous report), down 31.4% year to date. While investors have avoided highly leveraged stocks, like McClatchy, the weakness in the shares of Tribune Publishing is noteworthy. The company has virtually no long term debt and a large $95 million cash position. We would also note that stock performance comparisons do not reflect the $1.50 per share special cash dividend which was paid on July 2, 2019.

We believe that high debt leverage is likely to over hang the industry, even as investors digest the new Gannett, following the merger with New Media. In our view, the relatively high debt of the combined company likely will be a significant hurdle for investors. As such, we believe that there is an opportunity for the Tribune Publishing shares to shine. In our view, the company is in a solid position given its solid balance sheet and ability to make acquisitions that could transform and/or transition the company toward revenue and cash flow growth.

Digital Media

Stocks hit a speed bump

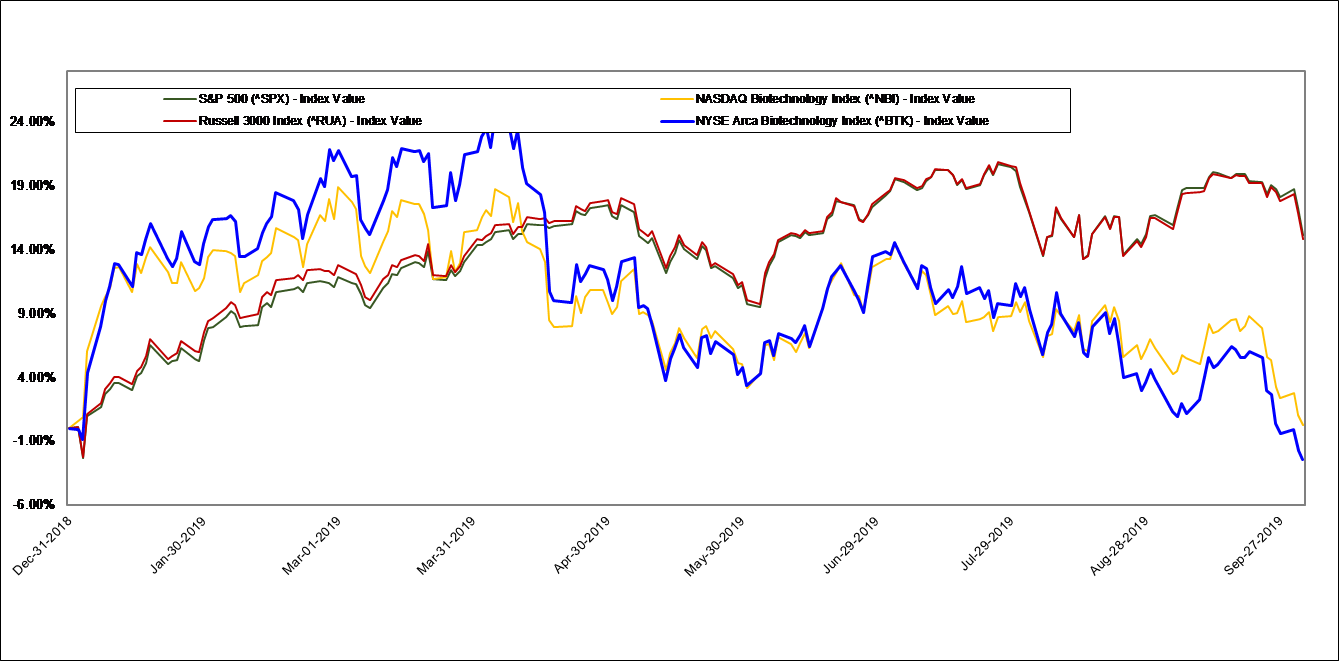

Internet & Digital Media Stock Price Performance: The third quarter of 2019 was a difficult quarter for the market in general and for three of Noble’s four internet and digital media sectors. The S&P 500 Index was up 1% in the third quarter which only Noble’s Digital Media Index (+4%) outperformed. Noble’s Marketing Tech (-3%), Social Media (-6%) and Ad Tech (-14%) Indices all underperformed the broader market. Through the first nine months of the year, the S&P Index was up 19%, while Noble’s Social Media (+40%), Ad Tech (+36%), and Marketing Tech (+24%) Indices outperformed the S&P while the Digital Media Index (+14%) underperformed.

Digital Media: Noble’s Digital Media Index (+4%) outperformed the S&P 500 (+1%), driven almost entirely by shares of Alphabet (GOOG, +13%). Other than microcap stock The Maven (MVEN, +37%), which recently acquired TheStreet.com, no other digital media stock was up in the quarter. Interactive Corp (IAC, +0%), was flat, while Netflix (NFLX, -27%) and Spotify (SPOT, -22%) were down. The most notable trend in the sector are the streaming content wars as services such as Netflix, Amazon Prime Video, Hulu, Disney+, HBO Now, Peacock (NBCUniversal’s streaming service), AppleTV Plus and others compete to provide ‘bingeable’ programming to its users. Netflix recently lost the U.S. streaming rights to both The Office and Friends. Peacock agreed to pay $500 million for the domestic streaming rights to The Office for 5 years beginning in 2021. Warner Media’s HBO Max agreed to pay $425 million for the domestic streaming rights to Friends for 5 years starting in 2020.

Social Media: Social media stocks were down in the third quarter, reflecting weakness in shares of Facebook (FB, -8%) and The Meet Group (MEET, -6%). Nevertheless, several social media stocks performed well in the quarter, led by Twitter (TWTR, +18%) and Snap, Inc. (SNAP, +11%). The biggest news in the sector was Facebook’s early September launch of Facebook Dating in the U.S. The service, which began rolling out overseas last year, provides users 18 years and up to access a suite of features, including specialized profiles and a matchmaking algorithm, designed to help find meaningful relationships. The service presents users with potential matches based on location and indicated preferences. Instagram is fully integrated into the service and allows users to share Instagram or Facebook stories.

MarTech: Noble’s Marketing Technology Index finished the quarter down 5%, though year-to-date results are much stronger (+24%). Third quarter 2019 performance leaders include Cardlytics (CDLX, +29%, after being up 57% in the second quarter 2019), LivePerson (LPSN, +27%), and Akamai (AKAM, +14%). Laggards during the quarter included SharpSpring (SHSP, -25%), and Yext (-21%). Competition in the marketing technology sector is currently fueled by the post-GDPR transition from cookie-based marketing to people-based marketing. This is putting a premium on data assets and cross-device identity solutions so that marketers can more effectively use their own data about their customers and deliver relevant marketing messages to individuals across multiple online platforms and devices.

Ad Tech: Noble’s Ad Tech Index fell by 16% in the third quarter 2019, but for the year it is up 36%. Eight of the sector’s twelve stocks were down in the quarter. The strongest quarter was turned in by Perion Networks (PERI, +68%) as the company turned the corner and posted year-over-year revenue growth for the first time in 3 years. Its search revenues were strong (+21%) while its Undertone advertising sector demonstrated a strong pipeline of new business for its new Synchronized Digital Branding solution, which uses AI to personalize the customer journey, and enable advertisers to deliver the right message at the right time. Rubicon Project (RUNI, +37%) also posted strong revenue growth and a big swing to positive EBITDA in the second quarter 2019 vs. EBITDA losses in the second quarter 2018. Laggards in the sector included SRAX (SRAX, -50%) and Fluent (-49%), both missed Street expectations.

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Director of Research. Senior Equity Analyst specializing in Media & Entertainment. 34 years of experience as an analyst. Member of the National Cable Television Society Foundation and the National Association of Broadcasters. BS in Management Science, Computer Science Certificate and MBA specializing in Finance from St. Louis University. Named WSJ ‘Best on the Street’ Analyst six times.

FINRA licenses 7, 24, 66, 86, 87.

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of

transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc..

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS |

% OF SECURITIES COVERED |

% IB CLIENTS |

| Outperform: potential return is >15% above the current price |

86% |

25% |

| Market Perform: potential return is -15% to 15% of the current price |

14% |

2% |

| Underperform: potential return is >15% below the current price |

0% |

0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same. Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 11091